Microsoft, founded in 1975 by Bill Gates and Paul Allen, is a global technology leader with a market capitalization exceeding $2 trillion.

Headquartered in Redmond, Washington, the company operates in over 190 countries and has transitioned from a software company to a diversified tech conglomerate.

Initially known for its Windows operating system, Microsoft has expanded into;

- Cloud computing (Azure)

- Enterprise solutions (Office 365)

- Gaming (Xbox)

- Professional networking (LinkedIn).

Microsoft’s revenue for fiscal 2023 was an impressive $211.915 billion, reflecting a 7% growth year-over-year.

The company’s financials show strong cash flow. This allows it to reinvest in emerging technologies like artificial intelligence and quantum computing.

This makes Microsoft an ideal example for SWOT analysis. It demonstrates clear strengths such as a diversified portfolio and market leadership, while also facing weaknesses, opportunities, and threats that affect its strategy and future direction.

Now, let’s break down the SWOT Analysis of Microsoft.

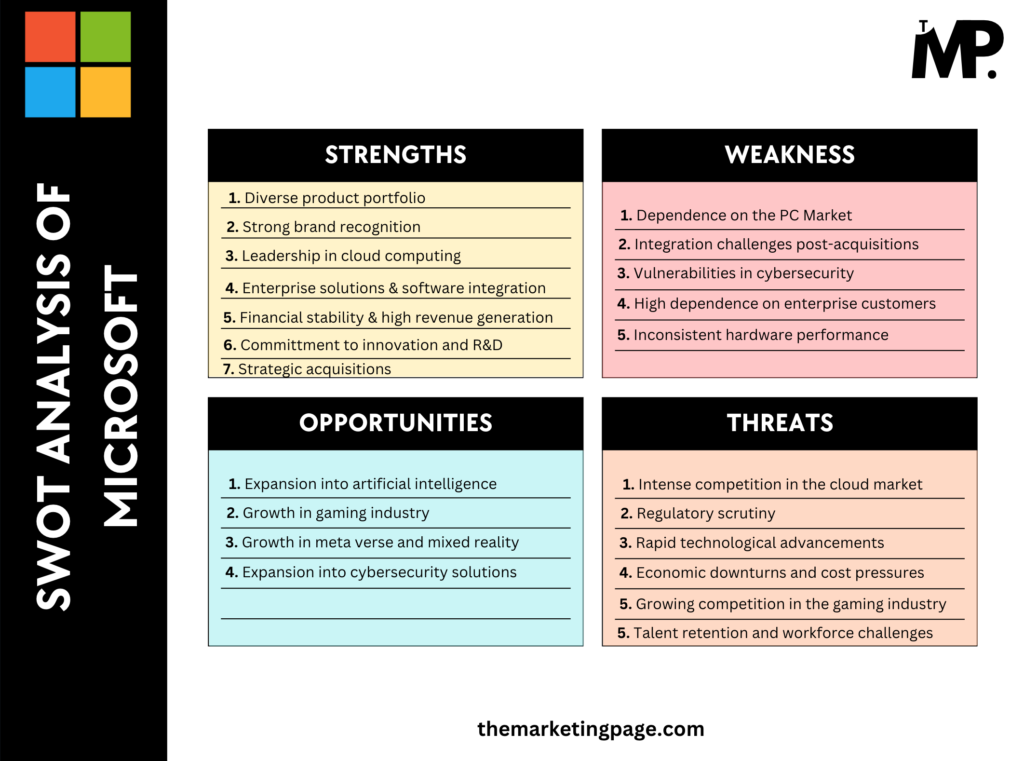

Microsoft SWOT Analysis

Microsoft Strengths

1. Diverse product portfolio

Microsoft has a diverse range of products. These include operating systems (Windows), cloud computing (Azure), business software (Office 365), gaming (Xbox), and hardware (Surface tablets).

This wide-ranging portfolio helps the company mitigate risk and reduce dependence on any single product or service.

It ensures that the company remains resilient even when one segment faces challenges.

Why it’s a strength: Microsoft’s diverse range of products helps it serve both individual consumers and businesses. By being involved in various industries, the company can take advantage of different market trends.

For example, Azure and other cloud services drove a 33% revenue growth in the Intelligent Cloud segment, contributing to a 20% overall increase in revenue for Microsoft’s cloud business.

Also, Microsoft’s acquired GitHub in 2018 and LinkedIn in 2016. This has increased its presence in professional networking and software development.

The Office 365 ecosystem has over 400 million users. This huge base is contributing significantly to the company’s recurring revenue model.

2. Strong brand recognition

Microsoft has built a globally recognized brand that is synonymous with personal computing and business productivity.

Its Windows OS dominates the global PC market, and Office applications are ubiquitous in business environments.

Why it’s a strength: Strong brand recognition ensures customer loyalty and allows the company to introduce new products effectively.

For example, Microsoft’s transition from a primarily software-focused company to a cloud-first company has been facilitated by its powerful brand, which remains trusted by customers worldwide.

Supporting facts for the strength are;

- Windows OS holds more than 72% of the global desktop market share (This fact is based on March 2025).

- Microsoft ranks as the second-most valuable global brand, according to Brand Finance’s 2023 report.

3. Leadership in cloud computing

Microsoft’s Azure platform is one of the top cloud services in the world. It is competing with Amazon Web Services (AWS) and Google Cloud.

Azure provides infrastructure, platform, and software-as-a-service offerings, with a wide range of products designed for enterprises.

Why it’s a strength: As businesses and governments increasingly migrate to the cloud, Microsoft’s deep integration of its software products with Azure makes it an attractive option.

The company’s ability to offer a comprehensive ecosystem of services gives it a competitive edge over other cloud providers.

Azure and other cloud services revenue grew 30% driven by growth, as of FY2024 Q2.

4. Enterprise solutions & software integration

Microsoft’s enterprise solutions, including Dynamics 365, SharePoint, and Microsoft Teams, are widely used across industries for collaboration, CRM, and ERP.

The company’s software integrates seamlessly with its cloud services, creating an all-in-one ecosystem.

Why it’s a strength: The company’s enterprise solutions enhance operational efficiency for businesses and organizations worldwide.

For example, Microsoft Teams now has over 300 million monthly active users. These active users position it as a leader in the enterprise collaboration space.

There are varied flavors of Dynamics 365 according to the community. This strengthens Microsoft’s role in the enterprise sector.

5. Financial stability & high revenue generation

Microsoft has a strong financial track record, consistently posting high revenue and profitability.

The company’s business model—driven by software subscriptions, cloud computing, and hardware sales—provides financial stability and growth.

Why it’s a strength: Financial stability allows Microsoft to invest in new technologies, acquisitions, and research and development, positioning it for long-term success.

Microsoft’s 2025 annual revenue is $13 billion, up 175% year-over-year. A major portion of this growth comes from its cloud segment (Azure alone contributing significantly to the total revenue).

6. Commitment to innovation and R&D

Microsoft invests heavily in research and development (R&D) to stay ahead of technological advancements.

The company’s R&D efforts are focused on areas like artificial intelligence (AI), cloud computing, cybersecurity, and mixed reality.

Why it’s a strength:

This commitment to innovation helps Microsoft maintain its competitive edge and create new products and services that meet evolving market needs.

Microsoft commits to spending $80B on AI infra in 2025. This highlights its focus on technological innovation.

The company’s work in AI, including the integration of GPT-4 into Microsoft 365, demonstrates its leadership in cutting-edge technology.

7. Strategic acquisitions

Microsoft has consistently pursued strategic acquisitions to expand its product offerings and customer base.

Notable acquisitions include LinkedIn (2016), GitHub (2018), and ZeniMax Media (2021).

Why it’s a strength: Acquisitions allow Microsoft to diversify its business and tap into new markets. It also strengthen its core competencies in areas like professional networking, gaming, and software development.

- LinkedIn’s acquisition, for example, has enhanced Microsoft’s presence in the professional networking space, while GitHub has reinforced its position in the developer community.

- The ZeniMax Media acquisition gives Microsoft an edge in the gaming industry, especially with its Xbox platform and future Game Pass offerings.

Microsoft Weaknesses

1. Dependence on PC Market

While Microsoft’s software portfolio is diverse, its Windows OS remains a core revenue driver.

However, the personal computing market has become stagnant, with PC sales declining in favor of mobile devices and tablets. The shift away from PCs is concerning in the long run.

Why it’s a weakness: As more consumers and businesses shift to mobile computing, Microsoft’s reliance on the traditional PC market could limit its growth potential.

Worldwide PC shipments declined 1.3% from the third quarter of 2023.

2. Integration challenges post-acquisitions

Microsoft has made several major acquisitions, such as LinkedIn, GitHub, and most recently, Activision Blizzard.

While these acquisitions are strategically valuable, integrating these companies into Microsoft’s broader ecosystem has posed challenges.

Why it’s a weakness: Integration difficulties can lead to;

- Operational inefficiencies

- Employee retention issues

- Confusion over brand identity

- Increased costs

- Cultural clashes

- Customer confusion

… and more.

It can also divert management focus from core areas like software development and cloud infrastructure.

Microsoft faced significant regulatory scrutiny over its planned $69 billion acquisition of Activision Blizzard. This resulted in delaying or complicating the integration.

The LinkedIn acquisition, while successful, took several years to fully integrate and deliver on its promise of cross-platform synergies.

3. Vulnerabilities in cybersecurity

Despite Microsoft’s efforts to improve its cybersecurity infrastructure, its large software user base makes it a frequent target for cyberattacks.

Security flaws and breaches can damage Microsoft’s reputation and customer trust.

Why it’s a weakness: High-profile security breaches in Microsoft products raise concerns about reliability and security.

In 2023, Hackers breached Microsoft’s Exchange Online and Outlook services, affecting thousands of customers globally.

4. High dependence on enterprise customers

A significant portion of Microsoft’s revenue comes from enterprise customers through services like Azure, Dynamics 365, and Office 365.

While this focus is profitable, it also exposes Microsoft to risks during economic slowdowns when businesses cut IT spending.

Why it’s a weakness: Heavy reliance on enterprise clients creates vulnerabilities if businesses reduce spending or switch to alternative platforms.

In times of economic uncertainty, IT budget cuts can directly impact Microsoft’s revenue from enterprise products.

5. Inconsistent hardware performance

While Microsoft’s Surface devices and Xbox gaming consoles are successful in their niches, they do not contribute as significantly to overall revenue compared to software and cloud services.

The hardware segment has also seen periods of inconsistent sales and performance.

Why it’s a weakness: Microsoft struggles to compete with established hardware players like Apple and Sony in devices and gaming consoles.

The Surface lineup revenue decreased $1.8 billion (or 24%) year-over-year in 2023. This signalled challenges in gaining further market share.

Microsoft Opportunities

1. Expansion in artificial intelligence

AI technologies are rapidly gaining traction across industries.

Microsoft has invested heavily in AI research and development, integrating AI capabilities into its products like Office 365, Azure, and LinkedIn.

Why it’s an opportunity: As AI becomes a cornerstone of modern technology, Microsoft’s investment in AI gives it the chance to lead the next wave of innovation. Its Azure AI services are already seeing increasing demand, and partnerships with companies like OpenAI further strengthen its position in this space.

(But now, Microsoft said they they are competitors with OpenAI.)

Moreover, Microsoft has committed $2 billion to AI research, with AI offerings now driving significant growth in Azure.

2. Growth in the gaming industry

Microsoft’s Xbox division is one of the leading players in the gaming market.

The company has also expanded into game subscription services with Xbox Game Pass, a model that allows users to play games on-demand for a monthly fee.

Why it’s an opportunity: The gaming industry continues to grow, with revenues expected to exceed $200 billion by 2026. Microsoft’s investment in Xbox, game development studios, and cloud gaming positions it well to capitalize on this lucrative market.

Xbox Game Pass has over 34 million subscribers. This huge base makes it a dominant player in the gaming subscription market.

3. Growth in meta verse and mixed reality

The meta verse and mixed reality are emerging as the next big frontiers for digital interaction and collaboration.

Microsoft’s HoloLens and Mesh platform integrate augmented reality (AR) and virtual reality (VR) for immersive enterprise applications.

Why it’s an opportunity: The global metaverse market is expected to hit $936 billion by 2030.

Microsoft’s leadership in enterprise-grade AR and VR technologies gives it a significant head start in this space.

Applications like virtual meetings, training, and remote assistance powered by HoloLens can revolutionize industries like manufacturing, healthcare, and education.

4. Expansion into cybersecurity solutions

Cybersecurity has become a top priority for businesses worldwide as cyber threats continue to escalate.

Microsoft offers advanced cybersecurity solutions through products like Microsoft Defender, Azure Sentinel, and its Security Copilot powered by AI.

Why it’s an opportunity: The cybersecurity market is expected to grow to $345 billion by 2026.

Microsoft’s integration of AI into its security tools provides enterprises with proactive threat detection and mitigation capabilities.

This positions Microsoft as a trusted leader in enterprise security solutions, especially in the hybrid work and cloud-focused era.

Microsoft Threats

1. Intense competition in the cloud market

Microsoft faces fierce competition from Amazon AWS, Google Cloud, and other emerging cloud providers.

Despite its strong performance in the cloud space, AWS leads the market in terms of revenue and customer base.

Why it’s a threat: The cloud market is becoming increasingly crowded. The companies vying for a larger share of the rapidly growing industry. Microsoft must continue to innovate to maintain its competitive edge against AWS and Google Cloud.

AWS holds a 32% share of the global cloud infrastructure market, compared to Azure’s 23%. This growth rate of Microsoft’s cloud revenue indicates a competitive threat.

2. Regulatory scrutiny

Microsoft, like other tech giants, faces increasing regulatory scrutiny from governments around the world.

Issues such as antitrust concerns, privacy laws, and data protection regulations have the potential to impact Microsoft’s operations.

Why it’s a threat: Regulatory pressure can lead to fines and operational changes. It can also cause delays in product rollouts. For instance, Microsoft’s planned acquisition of Activision Blizzard faced delays due to antitrust investigations in various jurisdictions.

The European Union and US Federal Trade Commission have raised concerns over Microsoft’s acquisition of Activision Blizzard. Due to this, Microsoft’s planned acquisition of Activision Blizzard faced delays.

Moreover, Commission imposed € 899 million penalty on Microsoft for non-compliance with March 2004 Decision.

3. Rapid technological advancement

The tech industry evolves quickly, with breakthroughs in AI, quantum computing, and other emerging technologies.

Microsoft must continuously innovate to stay ahead of competitors and avoid losing market relevance.

Why it’s a threat: Failing to keep up with technological advancements can erode Microsoft’s competitive position.

For example, the rise of specialized AI platforms and new-age tools could challenge Microsoft’s Azure and AI offerings.

Tech rivals like Alphabet (Google) and startups focused on niche technologies continue to disrupt the market, posing a long-term threat.

4. Economic downturns

Global economic uncertainties, such as recessions, inflation, and rising operational costs, can negatively impact Microsoft’s business.

During economic slowdowns, businesses may reduce IT spending, affecting demand for Microsoft’s products and services.

Why it’s a threat: Microsoft’s revenue from enterprise software, subscriptions, and cloud services depends on consistent IT spending.

Economic downturns could slow the adoption of new technologies and reduce revenue growth. According to the study, 25% of firms cut their investment in R&D and 20% in technological diffusion respectively during the recession perids.

For example, companies may delay cloud migrations or software upgrades during uncertain economic periods.

5. Growing competition in the gaming industry

While Xbox remains a significant player, Microsoft faces tough competition from Sony PlayStation and emerging cloud gaming platforms.

Additionally, the gaming subscription market is becoming increasingly competitive with services like PlayStation Plus and cloud-based platforms like NVIDIA GeForce Now.

Why it’s a threat: Microsoft’s ability to grow its gaming division is critical for maintaining its foothold in this market. If Xbox Game Pass loses subscribers or underperforms, it could hinder growth opportunities.

Sony’s PlayStation continues to dominate in exclusive titles and sales, challenging Microsoft’s ability to expand its gaming ecosystem.

6. Talent retention and workforce challenges

The tech industry is highly competitive when it comes to attracting and retaining top talent.

Microsoft competes with companies like Google, Amazon, and Apple for skilled engineers, developers, and AI experts.

Why it’s a threat: Failure to attract and retain top talent can slow innovation and growth. High turnover rates may disrupt critical projects, particularly in emerging sectors like AI, cloud computing, and gaming.

The recent global trend of “quiet quitting” and the push for hybrid or remote work also adds challenges for managing a large, productive workforce.

Summing Up

Microsoft’s journey from a software giant to a $2 trillion tech conglomerate highlights its adaptability and leadership. With a strong presence in cloud computing, enterprise solutions, gaming, and innovation, Microsoft continues to dominate the tech landscape.

Key strengths include:

- Diverse Product Portfolio: Windows, Azure, Office 365, Xbox, and Surface.

- Cloud Leadership: Azure drives significant revenue growth (30% in FY2024 Q2).

- Financial Stability: $254 billion annual revenue (2024) with consistent growth.

- Innovation: $29 billion invested in R&D for AI, cloud, and cybersecurity.

However, challenges persist:

- Dependence on PC Market: Slower growth as mobile usage rises.

- Integration Issues: Post-acquisition inefficiencies.

- Cybersecurity Vulnerabilities: Persistent attacks on Microsoft services.

Opportunities include AI leadership, gaming industry expansion, and growth in cybersecurity solutions, while threats like regulatory scrutiny and cloud competition remain critical.

Microsoft’s strategic focus positions it for sustained innovation and long-term success.

Also read BCG Matrix of Microsoft [2025].

1 Comment