Founded in 2006 in Sweden, Spotify launched in 2008 as a response to the growing issue of digital music piracy

Spotify is the world’s largest audio streaming service which is constantly revolutionizing how people consume music, podcasts, and audio content.

It introduced an innovative freemium model, allowing users to stream music for free with ads or opt for a premium subscription for an ad-free experience.

Spotify operates in over 180 countries, with a massive presence in North America, Europe, Latin America, and parts of Asia and Africa.

Its global expansion strategy focuses on increasing accessibility through partnerships with telecom companies and integrating with smart devices like Amazon Echo, Google Nest, and Apple CarPlay.

Key Figures and Financial Performance

- Total Users: 675 million monthly active users, including 263 paying subscribers

- Premium Subscribers: 263 million

- Revenue (2023): €15.67 billion in revenue (June 2024)

- Market Share: Over 31.7% market share of the global music streaming industry

- Podcast Library: Over 40 million users in the US

Spotify has significantly disrupted the traditional music industry.

It has literally shifted consumption from physical albums and digital downloads to on-demand streaming.

This makes it the best example of SWOT Analysis.

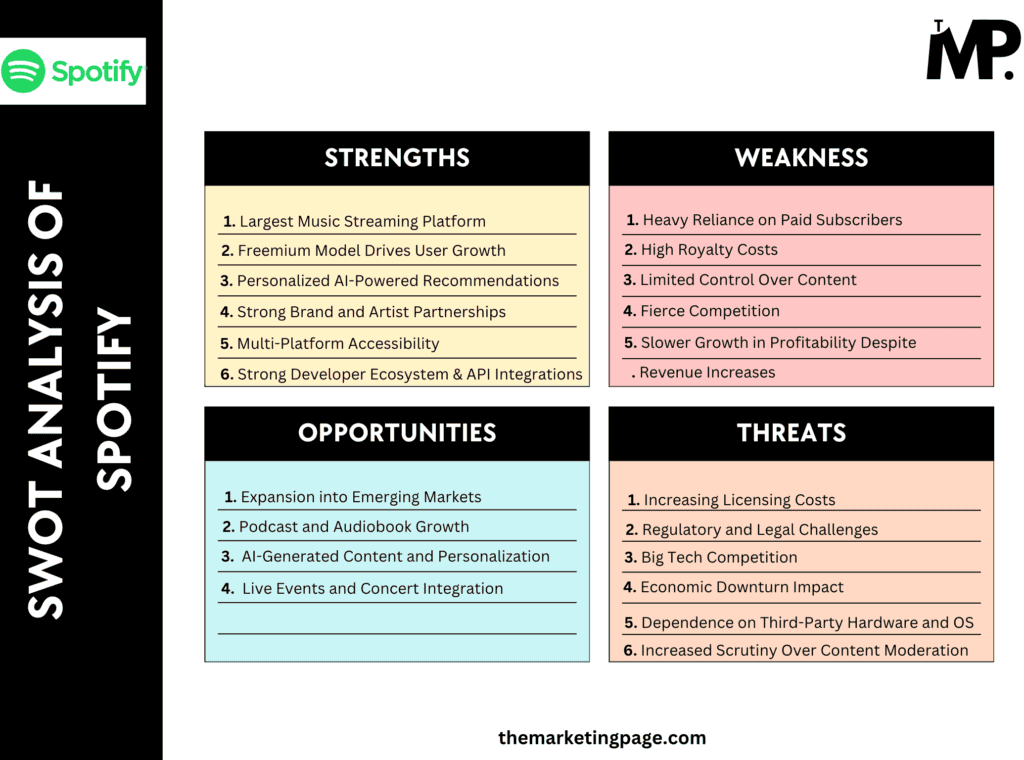

SWOT Analysis of Spotify

Strengths: What Makes Spotify a Market Leader?

1. Largest Music Streaming Platform

Spotify dominates the music streaming industry with a 31.7% market share which makes it the most widely used platform. It is ahead of Apple Music, Amazon Music, and YouTube Music.

Why It’s a Strength: Being the market leader gives Spotify a significant negotiating advantage with record labels and artists. Here you can read Spotify have updated their negotiation strategy. It allows them to secure better licensing deals and priority access to new music. This dominance also makes it the go-to platform for advertisers looking for exposure.

Spotify has 263 million premium subscribers (Q4 2024) which tells that it has a steady flow of subscription-based revenue. This also reduces reliance on unpredictable ad-generated income.

2. Freemium Model Drives User Growth

Unlike competitors that require upfront payment, Spotify’s freemium model allows users to listen to music for free with ads. This entices them to eventually upgrade to the premium experience.

Why It’s a Strength: By removing financial barriers, Spotify makes it easy for users to try the platform risk-free. Over time, as users get accustomed to the experience and want ad-free, offline listening, they upgrade to premium.

Spotify had 39% conversion rate in 2023 (600 million active users, with 236 million premium subscribers). It proves that the freemium approach effectively converts users into paying customers.

3. Personalized AI-Powered Recommendations

Spotify isn’t just a music streaming platform—it’s an AI-driven discovery engine. Features like;

use machine learning to tailor music recommendations to individual listening habits.

Why It’s a Strength: Personalized recommendations keep users engaged for longer, increasing streaming hours and reducing churn (cancellations). The more Spotify understands user preferences, the harder it is for competitors to pull them away.

People also discover new music from “Today’s Top Hits” which is the most popular Spotify playlist, with over 34.52 million followers.

4. Strong Brand and Artist Partnerships

Spotify collaborates with artists (The Crossover Effect: Artist Collaborations Thrive on Spotify), record labels, and exclusive content creators to offer unique content that’s not available elsewhere.

Why It’s a Strength: Having exclusive releases and podcasts increases user retention and attracts new subscribers. When major artists release content exclusively on Spotify, fans are compelled to stay on the platform.

The Joe Rogan Experience, a Spotify-exclusive podcast, attracts millions of listeners, driving both ad revenue and premium subscriptions.

Other exclusive deals, like the ones with Michelle Obama further strengthen Spotify’s competitive edge.

5. Multi-Platform Accessibility

Spotify is available on almost every digital device, including mobile phones, desktops, tablets, smart TVs, gaming consoles, and smart speakers like Alexa and Google Home.

Why It’s a Strength: Unlike some competitors that limit their services to certain ecosystems (e.g., Apple Music is best optimized for Apple devices), Spotify offers a seamless listening experience across all platforms.

Spotify Connect allows users to switch devices mid-stream without interruptions. It makes it easy for users to transition between listening on their phone, TV, or smart speaker without breaking their experience.

6. Strong Developer Ecosystem & API Integrations

Spotify provides developers with an API that allows third-party apps to integrate its services—e.g., Nike Run Club for workout playlists, Tinder for music-based matchmaking, and Discord for live listening sessions.

Why It’s a Strength: These integrations increase Spotify’s reach, embedding its ecosystem into various user experiences and driving engagement.

Weaknesses: Where Spotify Struggles

1. Heavy Reliance on Paid Subscribers

Spotify’s freemium model helps attract users, but its business heavily depends on converting them into premium subscribers. Spotify made nearly 88.19% of its revenue from paying users in 2024.

Why It’s a Weakness: If a significant number of users decide to cancel their premium subscriptions, Spotify’s revenue could take a massive hit.

Fluctuations in paid memberships directly impact profitability. It means, the music streaming industry is highly competitive, and if a competitor offers a better deal, many users may switch platforms.

2. High Royalty Costs

Spotify does not own most of the music it streams. Instead, it pays a large portion of its revenue (over 70%) to royalties.

Why It’s a Weakness: Despite Spotify’s growing user base and revenue, its profit margins remain thin due to these high operational costs. Even with record-breaking earnings, Spotify often struggles to turn a profit because the majority of its revenue is paid out before it can reinvest in growth or innovation.

3. Limited Control Over Content

Spotify is mostly a distributor rather than a creator of music.

It is not working like Netflix or other platforms that produce or own a large portion of their content,

This means it depends on licensing agreements with record labels and artists, who can choose to increase fees, restrict access, or remove their content altogether.

Why It’s a Weakness: If labels decide that Spotify’s payout structure isn’t favorable, they can negotiate higher fees or pull their content entirely, forcing users to switch to competitors. Without ownership over its core product (music), Spotify remains at the mercy of the industry.

In 2014, Taylor Swift removed her entire catalog from Spotify, citing unfair royalty payments.

This move frustrated millions of users and highlighted the platform’s vulnerability in content negotiations.

4. Fierce Competition

Spotify faces intense competition from Apple Music, Amazon Music, and YouTube Music (Source).

These companies bundle their music services with other premium offerings, making it harder for Spotify to compete solely as a standalone music platform.

Why It’s a Weakness: Unlike Spotify;

- Apple Music is part of the Apple ecosystem (Apple One)

- Amazon Music is included with Amazon Prime

- YouTube Music benefits from YouTube’s massive video streaming dominance.

Since, these competitors offer discounted or bundled services, they can lure users away from Spotify.

Apple Music has 93 million paid subscribers (5.68% increase), making it a direct and growing threat to Spotify’s premium model.

5. Slower Growth in Profitability Despite Revenue Increases

Despite generating billions in revenue, Spotify has struggled to achieve consistent profitability due to thin margins and high operational costs.

Why It’s a Weakness: Spotify reported a €166 million loss in 2023, even after price increases. Investors remain skeptical due to high expenses in licensing, R&D, and content acquisition, affecting stock performance.

Competitors like Apple and Amazon have stronger financial backing, making them less reliant on streaming profits.

Opportunities: Where Spotify Can Grow

1. Expansion into Emerging Markets

While Spotify dominates in North America and Europe (63% of Spotify Premium subscribers), there’s massive growth potential in emerging markets like Latin America, Asia, and Africa (Source)

These regions are experiencing a surge in internet penetration, smartphone adoption, and digital payments, making them ideal markets for music streaming services.

Why It’s an Opportunity: As more users in these regions gain access to affordable mobile data, streaming platforms like Spotify become more attractive. The freemium model helps introduce users to the platform, converting them into paying subscribers over time.

2. Podcast and Audiobook Growth

Spotify is no longer just a music streaming service—it’s aggressively expanding into podcasts and audiobooks to diversify its revenue. (Source)

Podcasts and audiobooks have higher profit margins since Spotify can own or exclusively license content.

Why It’s an Opportunity: Podcasts and audiobooks provide multiple monetization avenues, including advertising, premium subscriptions, and exclusive deals with creators. By offering a variety of content beyond music, Spotify reduces its reliance on record labels and creates a stronger value proposition for users.

Spotify invested $1 billion in podcast acquisitions, buying;

3. AI-Generated Content and Personalization

Spotify has always been a leader in personalization, but it’s now taking it further with AI-powered music generation and AI DJs.

Spotify can create customized audio experiences for users, making their listening sessions more engaging and unique.

Why It’s an Opportunity: AI-generated music and content can help Spotify reduce its dependence on expensive record label agreements while keeping users engaged.

If Spotify can create compelling AI-powered music, it could offer exclusive content that competitors can’t match.

Spotify’s AI DJ, called “X”, is already available and enhancing user engagement by providing a curated, interactive music experience based on listening habits.

4. Live Events and Concert Integration

Spotify is moving beyond digital streaming by exploring live event promotions and ticket sales (Source).

It launched Spotify Tickets in 2022, allowing users to buy concert tickets directly from the platform instead of going through third-party sellers like Ticketmaster.

Why It’s an Opportunity: Selling tickets directly to users not only provides an additional revenue stream but also strengthens Spotify’s relationship with artists and fans. If executed well, this could position Spotify as a one-stop music experience—from discovering artists to attending their live concerts.

Threats: Risks Spotify Faces

1. Increasing Licensing Costs

Spotify does not own most of the music it streams, meaning it has to pay licensing fees to record labels and artists. The split is 70% for artists and 30% for Spotify.

Spotify Says It Paid $7 Billion In Royalties In 2021 Amid Claims Of Low Pay From Artists.

However, music labels continuously push for higher royalty payments, which directly impacts Spotify’s profit margins.

As revenue grows, record labels demand a bigger share, putting constant financial pressure on the company.

Why It’s a Threat: If royalty costs increase too much, Spotify may have to raise subscription prices or cut costs elsewhere—both of which could lead to losing users to competitors with more affordable plans.

Music labels have repeatedly pressured Spotify to increase subscription prices (Source)to boost artist payouts, which could make the platform less competitive in price-sensitive markets.

2. Regulatory and Legal Challenges

Like many tech companies, Spotify faces constant legal scrutiny over issues like artist payouts, copyright disputes, and antitrust concerns.

Over the years, it has dealt with lawsuits from musicians, music publishers, and industry groups demanding fair compensation.

Additionally, government regulations in different countries can force Spotify to change its business model or limit certain features.

Why It’s a Threat: Lawsuits and regulatory fines can cost Spotify millions of dollars and damage its reputation. If stricter laws are introduced (such as higher minimum payouts for artists), Spotify’s operating costs could significantly rise.

In 2018, Spotify settled a $112 million lawsuit over unpaid royalties, highlighting the financial risks of legal disputes.

3. Big Tech Competition

Unlike Spotify, companies like Apple, Google, and Amazon don’t rely solely on music streaming to generate revenue.

They use their ecosystems to bundle music streaming services with other products and services, making it harder for Spotify to compete on pricing and value.

Why It’s a Threat: Tech giants offer music streaming at lower costs (or even for free with other services), making them an attractive alternative for consumers. For example, Apple Music is often bundled with Apple One, and Amazon Music is included with Prime, making it difficult for Spotify to retain price-sensitive users.

Apple Music has secured exclusive album releases from major artists like Drake’s Views, Kanye West’s The Life of Pablo, and Chance the Rapper’s Coloring Book.

This gives Apple Music an edge in attracting users who want early access to new music.

4. Economic Downturn Impact

In times of economic uncertainty or recession, consumers prioritize essential expenses and often cut back on non-essential subscriptions like music.

Spotify’s premium monthly ARPU in Q1 2020 was down 6% year-on-year

This was evident during past economic downturns when many users downgraded to the free ad-supported tier to save money.

Why It’s a Threat: Since premium subscriptions contribute nearly 88% of Spotify’s revenue, a decline in paid users would significantly impact revenue growth.

Additionally, advertisers may reduce ad spending during economic slowdowns, further affecting Spotify’s earnings from free-tier users.

5. Dependence on Third-Party Hardware and OS

Spotify relies on Apple’s iOS and Google’s Android ecosystems to distribute its app. Both companies control app store policies, fees, and permissions, impacting Spotify’s revenue.

Why It’s a Threat: Apple has already restricted Spotify’s in-app purchases to avoid App Store fees, forcing users to subscribe via the web. Future policy changes or increased fees could further impact Spotify’s margins and user experience.

6. Increased Scrutiny Over Content Moderation

Spotify has faced controversies over podcast content, particularly regarding misinformation, political bias, and offensive material.

High-profile cases like The Joe Rogan Experience controversy have led to artist boycotts and public backlash.

Why It’s a Threat: If Spotify fails to balance free speech with responsible moderation, it risks losing artists, advertisers, and users, damaging its brand reputation.

Final Thoughts

Spotify has redefined the way people consume music and audio content.

With its market-leading position (31.7% share), AI-powered personalization, and freemium model, it has built an unmatched global presence.

Its ability to convert 39% of free users into premium subscribers proves the effectiveness of its strategy.

However, challenges persist. High royalty costs (70% of revenue), dependence on paid users, and fierce competition from tech giants like Apple and Amazon put financial pressure on Spotify.

While it continues to expand into podcasts, audiobooks, and live events, profitability remains a concern due to thin margins and increasing licensing fees.

Opportunities lie in emerging markets, AI-driven content, and exclusive artist deals, but regulatory risks and economic downturns could impact growth.

To stay ahead, Spotify must innovate beyond music streaming—leveraging AI, exclusive content, and direct artist collaborations to maintain its dominance.

In the evolving digital landscape, Spotify’s future success hinges on balancing innovation, profitability, and user experience while navigating industry challenges.

Leave a Comment