Founded in 1960 by Tom and James Monaghan in Ypsilanti, Michigan, Domino’s Pizza has grown from a small pizzeria into a global fast-food giant.

Today, it operates in more than 90 countries with a vast network of over 20,900 stores, making it one of the largest pizza chains in the world.

Domino’s has revolutionized the pizza delivery industry, setting new standards with speed, convenience, and technology-driven solutions.

From its early days, Domino’s focused on delivery-first operations, a strategy that helped it dominate the market. Over time, it expanded its menu beyond traditional pizzas, adding pasta, chicken, sandwiches, and desserts.

It was one of the first pizza brands to introduce Domino’s Tracker (2008), and GPS driver tracking (2019)—making it a tech-driven food giant rather than just another pizza chain. Its ability to constantly evolve and adapt to customer needs has allowed it to stay ahead of competitors.

Key Highlights:

- Revenue: $4.665B, a 4.41% increase year-over-year (2024)

- Net Income: $0.572B, a 9.98% increase year-over-year (2024)

- Market Presence: Over 90 countries

- Store Count: More than 18,000 locations

- Franchise Model: 98% of stores are franchise-owned, fueling global expansion

Domino’s isn’t just a pizza brand—it’s a logistics powerhouse with an unmatched delivery ecosystem.

Let’s now break down its SWOT analysis to understand what makes it a market leader.

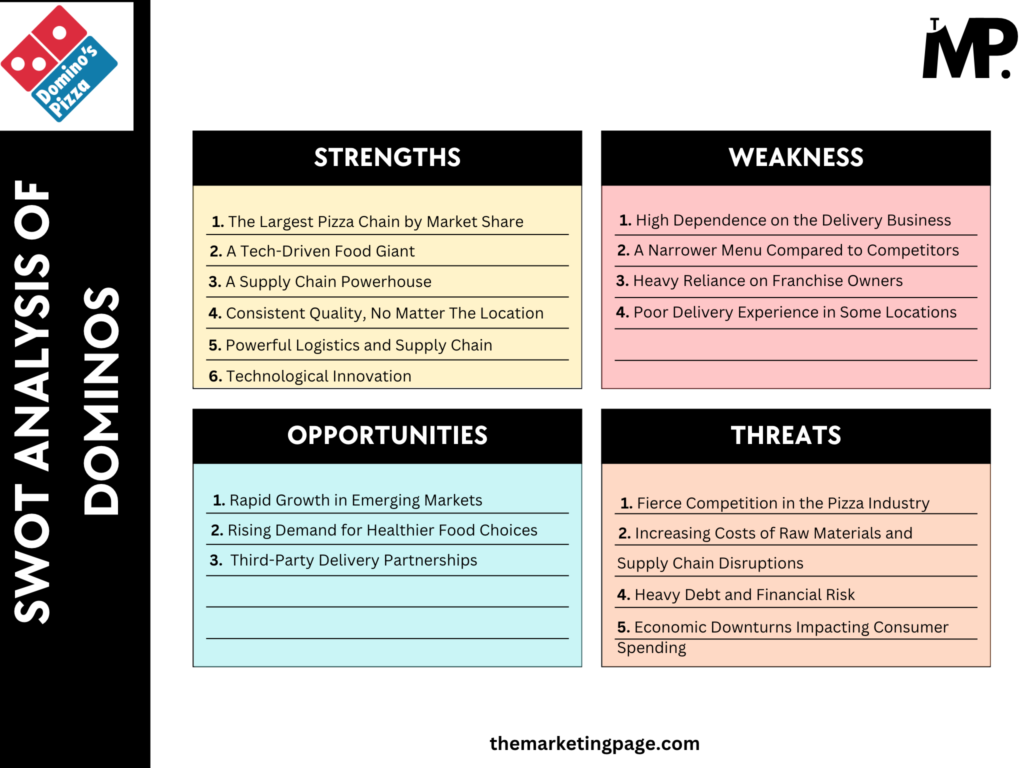

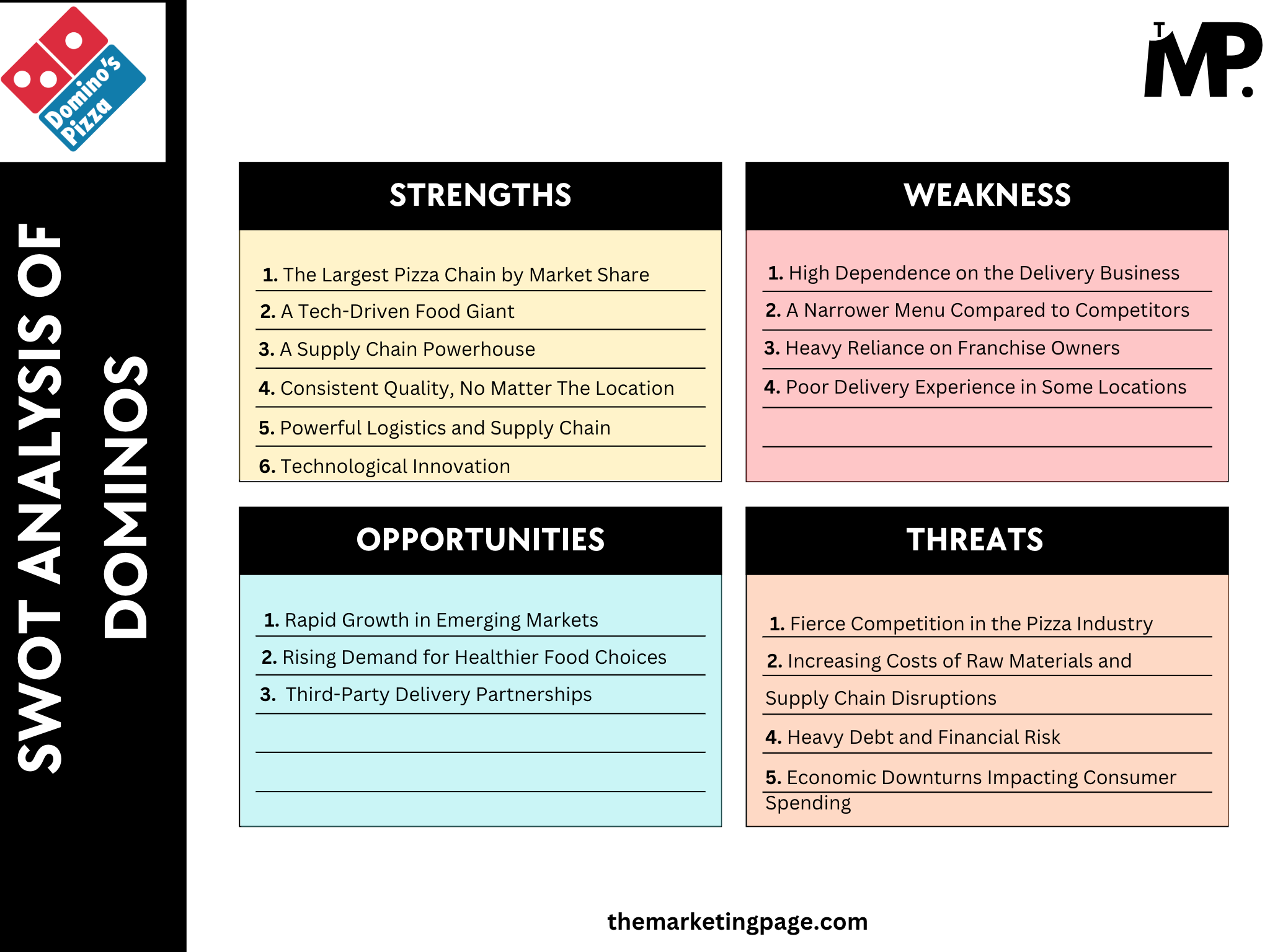

SWOT Analysis of Dominos

Strengths of Domino’s Pizza

1. The Largest Pizza Chain by Market Share

Dominos is the dominant leader in the market with a 40% market share in the U.S. pizza industry.

It is operating in 90+ countries with over 18,800 stores and has created a globally recognized brand that people associate with fast, reliable pizza delivery.

Why it’s a strength? Domino’s has spent decades building a strong brand identity through consistent advertising and a focus on delivery-first operations. It has strategically expanded in major markets like North America, Europe, and Asia, ensuring its logo and product are instantly recognizable.

When people think of ordering pizza, Domino’s is often their first choice—a competitive edge that smaller brands struggle to achieve. It’s all because it is a globally trusted brand which automatically attracts customers.

2. A Tech-Driven Food Giant

Dominos report that they have 5.3M active users on their mobile app (2022). This prove its success in digital transformation.

It wasn’t just the major pizza chain to go for online ordering—it went further by implementing AI-powered ordering, GPS tracking, and even robotic delivery tests.

Why it’s a strength? The company has consistently invested in technology, ensuring customers can order quickly and conveniently. Features like the Domino’s Tracker (2008) allow users to monitor their order in real time, while AI chatbots help customers place orders without human interaction.

This differentiates it from competitors like Pizza Hut, which took longer to fully implement digital solutions.

3. A Supply Chain Powerhouse

Domino’s total locations in the US alone are is 6,887 in number. This makes sure that its stores receive fresh ingredients quickly and efficiently.

Unlike many competitors, Domino’s owns and controls its supply chain which reduces costs and improve consistency across locations.

Why it’s a strength? The company has centralized supply chain operations, making sure every store—whether in New York, London, or Sydney—receives the same quality ingredients at the right time. This prevents disruptions and allows for bulk purchasing, keeping ingredient costs lower.

An efficient supply chain means;

- Faster deliveries

- Fewer shortages

- Lower operational costs

- Improved supplier relationships

- Consistent product quality across the world

- Optimized warehouse and logistics efficiency

- Improved compliance with industry regulations

This level of control also allows Domino’s to respond quickly to demand spikes, such as during major sports events.

4. Consistent Quality, No Matter The Location

Customers trust Domino’s because they know exactly what to expect—whether they’re ordering in Los Angeles, Tokyo, or Berlin. Unlike many local pizza chains, Domino’s has standardized recipes, high-quality ingredients, and strict quality controls (Source 1 and Source 2).

Why it’s a strength? Domino’s works closely with long-term supply chain partners with over 120 years of combined experience in pizza-making. It also trains franchisees to follow strict preparation methods, ensuring that every pizza meets the same quality standards worldwide.

When customers get a reliable, high-quality product every time, they’re more likely to order again and again. This builds trust and brand loyalty, helping Domino’s maintain its strong market position.

5. Powerful Logistics and Supply Chain Management

Domino’s operates one of the most efficient supply chain systems in the food industry. Its distribution model allows franchisees to focus on operations rather than inventory management.

Domino’s supply chain centers produce fresh dough and distribute more than 240 other products to Domino’s stores across the U.S. and Canada. (Source)

Why it’s a strength? An optimized supply chain reduces operational costs, ensures fresh ingredient availability, and enhances store profitability. This also helps Domino’s scale faster, making expansion into new markets smoother.

6. Technological Innovation in Ordering & Delivery

Domino’s has consistently been at the forefront of digital transformation. It is offering seamless online ordering, AI-powered recommendations, and GPS tracking for deliveries.

Why it’s a strength? The company has invested heavily in AI, automation, and mobile app development to enhance customer experience. Its pizza tracker system and voice-ordering AI (Dom) set it apart from traditional competitors.

Domino’s generated more than 75% of U.S. retail sales in 2021 via digital channels.

Domino’s introduced autonomous vehicle deliveries in 2021 through a partnership with Nuro, a self-driving car company, making it one of the first pizza brands to explore AI-powered delivery.

Weaknesses of Domino’s Pizza

1. High Dependence on the Delivery Business

Delivery is Domino’s biggest strength, but it’s also a potential risk.

Since a major contributor of it’s operations is home delivery, this reliance makes them vulnerable to shifts in consumer behavior.

Domino’s success has been built on its fast pizza delivery model. This focus is evident in their store designs (often prioritizing delivery over dine-in), technology investments (online ordering, GPS tracking), and marketing campaigns. This strong emphasis on delivery confirms its importance to their revenue generation.

Why it’s a weakness? If more customers opt for in-restaurant dining or prefer third-party delivery services (Uber Eats, DoorDash, and Grubhub) over Domino’s in-house delivery, the brand could lose market share. Dominos core business could suffer.

Delivery costs can consume a significant portion of revenue (10-15%), squeezing margins and making it challenging to maintain competitive pricing. This pressure is exacerbated by the need to compete with third-party services that may have different cost structures.

2. A Narrower Menu Compared to Competitors

Unlike Pizza Hut, which has diversified into pastas, wings, rice bowls, and even fusion dishes, Domino’s menu remains largely focused on pizza. While it has introduced some side dishes, it doesn’t offer the same menu variety that competitors do.

Why it’s a weakness? Domino’s still centers its business around pizza. A limited menu reduces Domino’s ability to attract non-pizza eaters, which could impact repeat business from customers who want variety.

This could also limit its reach in new markets where local food preferences differ from Western-style pizzas.

3. Heavy Reliance on Franchise Owners

Domino’s operates on a franchise-first model, with 95% of its stores globally owned by independent franchisees.

While this allows for rapid expansion, it also creates challenges in maintaining consistent quality and service standards.

Why it’s a weakness? Since most stores are not directly owned by Domino’s corporate, franchise owners have autonomy in managing operations. Franchise-run locations can sometimes have inconsistent customer experiences. This means service quality, delivery efficiency, and even customer satisfaction can vary from one location to another.

If a franchise fails to maintain high-quality standards, it can negatively impact the brand’s reputation as a whole.

4. Poor Delivery Experience in Some Locations

Point no. 3 leads us to inconsistent service across different locaqtions which has led to complaints about late deliveries, cold food, and unprofessional staff behavior.

A bad delivery experience can harm customer trust, leading them to switch to competitors like Uber Eats, DoorDash, or other pizza brands. Negative reviews also impact Domino’s brand perception and loyalty.

Why it’s a weakness? Since 95% of Domino’s stores are franchise-owned, delivery quality depends largely on individual franchise operations. Some locations struggle with understaffing and inefficient routing which leads to delays and dissatisfied customers.

Opportunities for Domino’s Pizza

1. Rapid Growth in Emerging Markets

With the middle class expanding rapidly in many developing countries, the demand for Western-style fast food is increasing.

Domino’s has already tapped into this trend, particularly in countries like India (1,900 stores) and China (1,008 stores), where it has seen significant growth.

Why it’s an opportunity? As incomes rise in Asia, Africa, and Latin America, more people can afford fast food as a regular dining option. Additionally, urbanization and changing lifestyles have increased the need for convenient, quick-service meals, making pizza delivery an attractive choice.

Since many competitors haven’t established a major presence in these regions, Domino’s has the advantage of being an early mover.

2. Rising Demand for Healthier Food Choices

The shift toward health-conscious eating has reshaped the food industry, with consumers actively seeking lower-calorie, gluten-free, and plant-based options.

While Domino’s is known for traditional pizza, it has the opportunity to expand its menu to appeal to health-conscious customers.

Domino’s has introduced plant-based pizzas, such as the Impossible Supreme, in select markets, responding to the growing demand for meat-free alternatives.

Why it’s an opportunity? The demand for vegan, vegetarian, and gluten-free options is rising, especially among younger consumers who prioritize nutrition and sustainability. Domino’s can attract a new customer base.

Competitors like Pizza Hut and Papa John’s have already introduced plant-based pizzas, making it necessary for Domino’s to adapt to changing preferences.

3. Expansion Through Third-Party Delivery Partnerships

Food delivery apps like Uber Eats, DoorDash, and Grubhub have revolutionized how people order food.

While Domino’s has its own delivery network, partnering with these platforms can help it reach new customers who prefer ordering from multi-restaurant apps.

Domino’s has already partnered with third-party platforms in multiple regions, and these collaborations continue to grow.

Why it’s an opportunity? Many customers exclusively use third-party apps for food delivery, often browsing for deals or convenience rather than ordering from a single-brand app.

Domino’s has historically resisted third-party partnerships, but with the growing dominance of food delivery aggregators, there’s a huge potential market to tap into.

It also helps Domino’s capture impulse buyers—customers who might not visit the Domino’s website or app but will order if they see it listed on a delivery platform.

Threats to Domino’s Pizza

1. Fierce Competition in the Pizza Industry

Dominos operates in a highly saturated industry with Pizza Hut, Papa John’s, and local pizza brands aggressively competing for market share.

These competitors frequently introduce new menu items and delivery innovations to stay ahead of the curve which makes it harder for any single brand to dominate.

Pizza Hut operates over 19,866 locations worldwide, and Papa John’s generates approximately $2 billion in annual revenue, making them formidable competitors for Domino’s.

Why it’s a threat? Apart from traditional rivals, Domino’s also faces competition from third-party delivery services like Uber Eats and DoorDash, which allow independent restaurants to offer pizza delivery without the need for an in-house fleet. This diversifies customer choices, making loyalty to a single brand more challenging.

Additionally, newer, more innovative food startups could disrupt the pizza industry with healthier, plant-based alternatives.

2. Increasing Costs of Raw Materials and Supply Chain Disruptions

The rising cost of cheese, wheat, and vegetables—key ingredients in pizza production—has significantly impacted Domino’s operational expenses. This issue is further exacerbated by transportation and labor costs, which make delivery more expensive.

Why it’s a threat? Global inflation and supply chain disruptions (such as those seen during the COVID-19 pandemic) have caused ingredient price volatility (Source). The dairy industry, in particular, has been hit by fluctuating cheese prices, a core component of Domino’s menu.

In 2021, the cost of cheese skyrocketed which significantly affected Domino’s profit margins. (Source)

Higher costs put pressure on profit margins. If Domino’s raises its menu prices, it risks losing customers to competitors with more budget-friendly options.

On the other hand, if it chooses to absorb the costs, it reduces profitability, making expansion and innovation more difficult.

3. Heavy Debt and Financial Risk

High debt levels mean that Domino’s must allocate more revenue to loan repayments, limiting its ability to invest in marketing, R&D, and new market expansion. If revenue slows down, this could create financial strain.

As of 2024, Domino’s had over $5.20 billion in long-term debt which makes it it heavily reliant on consistent revenue growth to manage financial obligations.

Why it’s a threat? Domino’s has aggressively expanded its operations, leading to higher borrowing for new store openings and technology investments. Additionally, rising interest rates could increase its debt servicing costs.

4. Economic Downturns Impacting Consumer Spending

Economic recessions and financial crises often reduce consumer spending power. This lead to a drop in demand for fast food and takeout.

Domino’s is particularly vulnerable to these shifts since pizza is often considered a discretionary expense rather than an essential purchase.

During the 2008 financial crisis, fast-food sales declined significantly, and even industry leaders like Domino’s saw a dip in revenue due to reduced consumer spending. (Source)

Why it’s a threat? When people experience job losses, inflation, or financial instability, they tend to cut back on non-essential spending. During economic downturns, consumers may choose home-cooked meals over ordering pizza, impacting Domino’s sales.

A prolonged economic downturn could force Domino’s to offer steeper discounts, which may hurt its profitability. It could also lead to fewer store openings or closures in underperforming markets.

Moreover, if Domino’s cannot maintain its affordable pricing model, customers may shift to cheaper fast-food alternatives.

Conclusion

Domino’s isn’t just a pizza company—it’s a tech-driven, logistics powerhouse that revolutionized the delivery game.

From its AI-powered ordering to one of the most efficient supply chains in the food industry, it has built a system that keeps customers coming back.

But like any giant, it has challenges to tackle. Heavy reliance on delivery, inconsistent franchise quality, and a limited menu could slow down growth if not managed well.

What’s Next for Domino’s?

To stay ahead, Domino’s can:

→ Expand in emerging markets where demand for fast food is rising

→ Offer healthier menu options to match evolving consumer preferences

→ Improve franchise oversight to ensure consistent service worldwide

→ Double down on tech innovation to stay ahead of competitors

How Domino’s navigates this will shape its future in the ever-evolving food industry.

Leave a Comment