Uber Technologies Inc. is a global ride-hailing giant that revolutionized urban mobility.

Founded in 2009 by Garrett Camp and Travis Kalanick, Uber started as a simple idea—tap a button, get a ride. Today, it operates in 70+ countries and 10,000+ cities, serving over 130 million active users monthly (as of 2023).

Before Uber, taxi services were inefficient, expensive, and unreliable.

Uber introduced on-demand rides, dynamic pricing, and cashless transactions, making travel more convenient. The introduction of UberX, UberPOOL, and UberEats expanded its reach beyond just ride-hailing.

Key highlights:

- As of 2023, Uber has 161 million monthly active users globally.

- The company dominates markets in North America, Europe, Latin America, and Asia-Pacific.

- It controls around 76% of the U.S. ride-hailing market, making it the leading player ahead of competitors like Lyft and Bolt.

- Uber reported $43.9 billion in revenue in 2024, marking a 17% YoY increase.

- Despite years of losses, it finally achieved profitability in Q2 2023 with a net income of $394 million.

- Uber’s Gross Bookings (total payments received before driver payouts) stood at $40 billion in 2024, showing its scale.

With its tech-driven model, Uber continues to expand into new verticals while facing challenges such as regulatory scrutiny, profitability concerns, and market competition.

Let’s talk about Uber SWOT Analysis in detail.

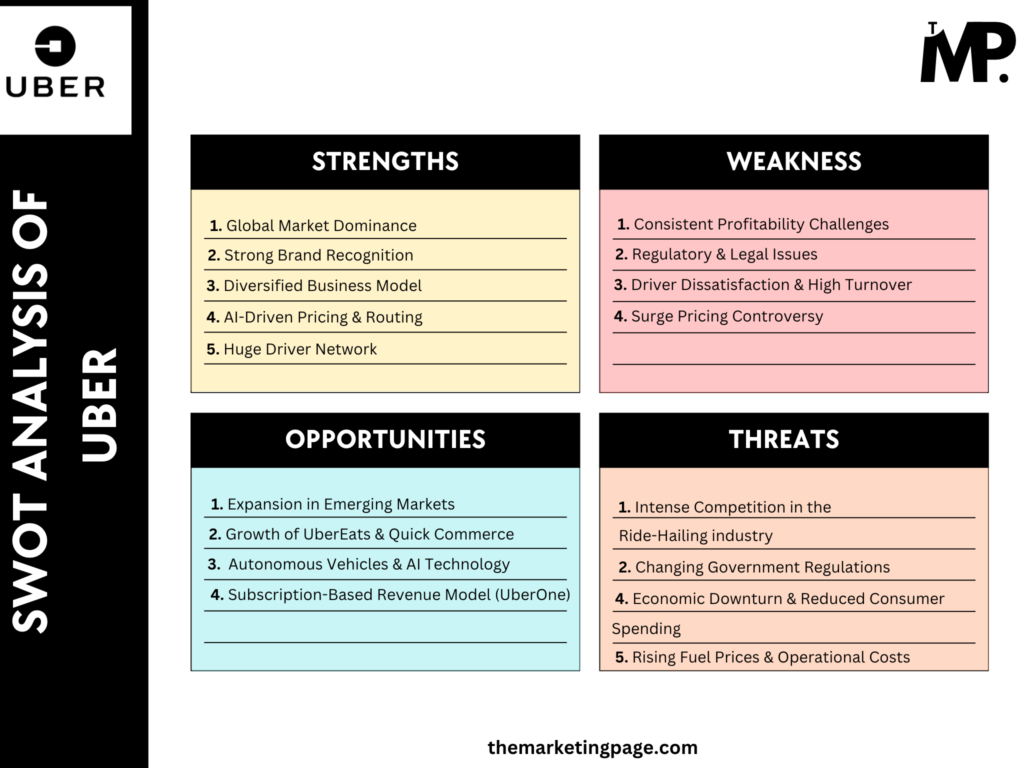

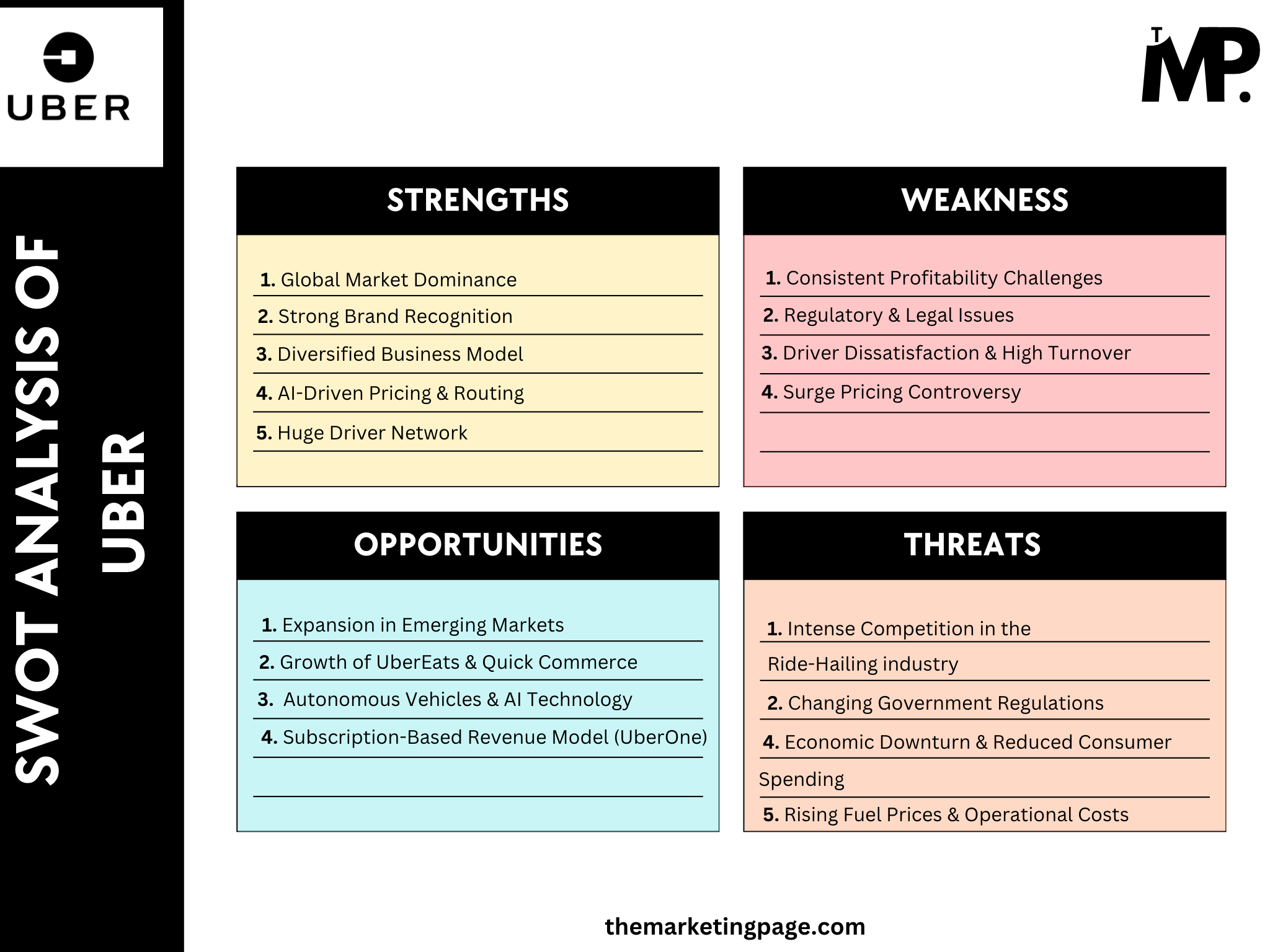

SWOT Analysis of Uber

Strengths: What Makes Uber a Market Leader?

1. Global Market Dominance

Uber operates in 10,000+ cities across 70+ countries, making it the largest ride-hailing service in the world. With 161 million monthly active users (As of 2024), it commands a significant share in major markets such as the United States, United Kingdom, and India.

Why it’s a strength? Having such a vast presence allows Uber to leverage economies of scale, meaning lower costs per transaction due to high ride volume. It also gives Uber a competitive advantage—new entrants struggle to match its global reach and infrastructure.

Uber controls 76% of the U.S. ride-hailing market, making it the dominant player over competitors like Lyft (30%) and smaller local services.

2. Strong Brand Recognition

Uber has become synonymous with ride-hailing, much like how “Google” became a verb for searching online. In many regions, people say “Let’s Uber” instead of “Let’s take a cab,” showing its strong brand influence.

Why it’s a strength? A well-known brand means higher customer trust, easier expansion into new markets, and lower marketing costs over time. It also helps in customer retention—people are more likely to choose Uber over lesser-known alternatives.

Also Read: How Uber’s “Thank You for Not Riding” Campaign Built Trust?

Uber was ranked among the Top 100 Most Valuable Brands in 2024 globally, with a change of +27.6% in brand value.

3. Diversified Business Model

Uber isn’t just a ride-hailing company. It has expanded into multiple sectors:

- UberEats – A food delivery service competing with DoorDash and Deliveroo.

- Uber Freight – A logistics platform that connects truck drivers with businesses needing cargo transportation.

- Uber Reserve – A premium service allowing users to schedule rides in advance.

Read all Uber services, products, and other offerings.

Why it’s a strength? By diversifying its services, Uber reduces its reliance on just one revenue stream. If ride-hailing faces a downturn (like during COVID-19), UberEats and Freight can keep revenue flowing.

4. AI-Driven Pricing & Routing

Uber uses machine learning and AI to optimize pricing and routes in real time. It adjusts fares dynamically based on demand (surge pricing) and ensures efficient driver-rider matching.

Why it’s a strength? AI-powered pricing allows Uber to maximize revenue during peak hours which makes sure that drivers stay motivated to work.

Route optimization also means shorter trips and lower fuel costs along with better rider satisfaction.

Read how Uber’s dynamic pricing work?

5. Huge Driver Network

Uber operates with a network of over 8 million drivers worldwide (as of 2024).

Unlike traditional taxi services, it doesn’t own vehicles, keeping capital expenditure low. Instead, it acts as a marketplace connecting drivers and riders.

Why it’s a strength? A large driver network means shorter wait times, better ride availability, and lower operational risks. Uber can also scale quickly—whenever it enters a new market, it can onboard drivers faster than traditional taxi companies can expand.

Uber drivers collectively completed 11.27 billion trips in 2024, showing the scale and efficiency of its network.

Weaknesses: Uber’s Major Challenges

1. Consistent Profitability Challenges

Despite its massive revenue growth, Uber has consistently struggled with turning a net profit due to high operational costs, driver incentives, market saturation, competition and regulatory expenses. (Source)

While its gross bookings are in the billions, factors like subsidies for drivers, marketing spend, and legal battles eat into profitability.

Why it’s a weakness? Investors look for long-term financial stability before betting big on a company. Uber’s history of net losses makes its stock volatile, leading to concerns about sustainability. Additionally, the company must continuously invest in growth initiatives, further delaying consistent profitability.

Uber turned its first profitable quarter in 2023 after years of cumulative losses, but it remains under pressure to maintain this trend.

2. Regulatory and Legal Issues

Uber faces stringent regulations and frequent legal battles across various countries. Some cities have outright banned it, while others impose heavy fines and restrictions. Governments often challenge Uber’s business model, arguing that it exploits drivers by classifying them as contractors rather than employees.

Why it’s a weakness? Legal battles increase operational costs and create uncertainty. Frequent lawsuits and government pushbacks hinder Uber’s ability to scale in new markets. In some cases, Uber has had to cease operations or modify its business model drastically, affecting revenue streams.

For example;

- London revoked Uber’s license in 2019 over safety concerns, forcing the company to appeal and implement stricter policies.

- California’s AB5 law required Uber to classify drivers as employees, increasing costs due to benefits, insurance, and labor protections.

3. Driver Dissatisfaction & High Turnover

Uber’s gig economy model means drivers aren’t full-time employees and lack benefits such as health insurance, paid leave, and job security (Source). This has led to frequent protests, strikes, and high driver turnover rates.

Why it’s a weakness? A dissatisfied driver base leads to higher recruitment and onboarding costs, affecting ride availability. If fewer drivers are willing to work;

- Wait times increase

- Customer experience declines

- Uber loses its reliability factor.

A survey revealed that 42% of Uber drivers quit within 6 months, forcing Uber to constantly spend on acquiring new drivers.

4. Surge Pricing Controversy

Uber’s dynamic pricing model adjusts fares based on demand, commonly known as surge pricing.

While this helps drivers earn more during peak hours, it often frustrates customers when fares skyrocket during emergencies, bad weather, or public events.

Why it’s a weakness? Negative public perception around surge pricing reduces customer trust (Source). In extreme cases, passengers look for alternatives like taxis or competitors with more stable pricing. Repeated backlash could lead to regulatory scrutiny, forcing Uber to adjust its pricing model.

For example, During a 2021 NYC snowstorm, Uber fares surged 4-5x higher than normal, leading to social media backlash and customers accusing Uber of exploiting emergencies for profit. (Source)

Opportunities: Where Uber Can Expand

1. Expansion into Emerging Markets

Countries like Indonesia, Brazil, and African nations present huge growth potential for Uber as ride-hailing adoption is rising rapidly. These regions have low car ownership rates and growing urban populations, making ride-sharing an essential service.

Why it’s an opportunity? Since public transportation is often unreliable in these regions, Uber can establish itself as the primary mobility solution. Additionally, operating costs in emerging markets are lower than in developed nations, increasing profit margins.

The Africa Ride-Hailing Market is expected to reach USD 2.53 billion in 2025, offering Uber a lucrative expansion opportunity.

2. Growth of UberEats & Quick Commerce

UberEats has evolved into one of the largest food delivery platforms, competing with major players like DoorDash, Zomato, and Deliveroo (Source).

However, Uber is now moving beyond food delivery and into quick commerce, focusing on delivering groceries, everyday essentials, and even pharmacy items within 15–30 minutes.

Why it’s an opportunity? As consumer habits shift toward faster and more convenient shopping, the demand for quick commerce services is increasing. Uber can leverage its existing driver network and logistics infrastructure to offer rapid, on-demand deliveries for more than just food. Expanding into grocery and essentials delivery will provide an additional revenue stream, reducing dependence on the ride-hailing business.

Uber Eats gross bookings reached $74.6 billion in 2024 (with $13.7B in revenue), proving it to be a key driver of Uber’s overall growth.

3. Autonomous Vehicles & AI Technology

Uber has invested heavily in self-driving technology, partnering with leading companies like Wayve, Waymo and Aurora to develop autonomous vehicle systems.

The goal is to eventually replace human drivers with AI-powered self-driving cars, creating a cost-efficient and scalable ride-hailing network.

Why it’s an opportunity? One of Uber’s biggest expenses is driver payouts, which significantly reduce profit margins. If Uber can successfully implement autonomous vehicles, it will eliminate driver costs, making fares cheaper for passengers while maximizing profit margins. Additionally, AI-driven technology can optimize route efficiency, reduce accidents, and enhance the overall user experience.

Uber previously tested self-driving car technology in Pittsburgh and San Francisco and continues investing in AI-driven mobility solutions.

If successful, this could completely transform the ride-hailing industry in the next decade.

4. Subscription-Based Revenue Model (Uber One)

Uber launched Uber One, a membership-based subscription plan offering ride discounts, free UberEats delivery, and exclusive perks for a fixed monthly fee. This model is designed to increase customer loyalty and generate recurring revenue.

Why it’s an opportunity? A subscription-based model helps Uber:

- Reduce reliance on one-time transactions by locking in users for the long term.

- Increase customer retention, as members are more likely to stick with Uber instead of switching to competitors.

- Ensure a stable revenue stream, making Uber less vulnerable to fluctuations in ride demand.

By Q3 2024, Uber’s premium membership service, Uber One, had surpassed 25 million monthly subscribers, significantly boosting Uber’s customer lifetime value and monthly recurring revenue.

Threats: Uber’s Biggest Risks

1. Intense Competition

Uber operates in a highly competitive ride-hailing market, facing strong rivals like Lyft in the U.S., Didi in China (Now Uber is not operating in China), Ola in India, Bolt in Europe, and Grab in Southeast Asia. These companies aggressively compete on pricing, driver incentives, and customer benefits, making it difficult for Uber to maintain dominance in every region.

Why it’s a threat? Competitors undercut Uber’s fares and offer higher earnings to drivers, forcing Uber to spend heavily on promotions and incentives to retain users and drivers. This affects Uber’s profit margins and weakens its hold on key markets. Additionally, local competitors often have better government relationships, allowing them to navigate regulatory challenges more effectively than Uber.

Uber was forced to exit China in 2016 after Didi captured 80% of the ride-hailing market, highlighting how competition can push Uber out of key regions.

2. Changing Government Regulations

Governments worldwide are tightening labor laws, licensing requirements, and wage regulations that directly impact Uber’s business model. One of the biggest legal battles Uber faces is whether its drivers should be classified as independent contractors or employees (Source).

Why it’s a threat? If drivers are reclassified as employees, Uber would have to pay minimum wages, provide benefits, and cover additional labor costs, significantly increasing operational expenses. Additionally, many cities are introducing stricter licensing laws and ride-hailing taxes, which could make Uber’s services less profitable or more expensive for users.

In 2021, the UK Supreme Court ruled that Uber drivers must be classified as workers, meaning Uber had to offer paid holiday, pensions, and minimum wages—increasing costs in one of its biggest markets. Similar laws in other regions could further strain Uber’s finances.

3. Economic Downturn & Reduced Consumer Spending

Uber’s business depends on consumer spending habits, and during economic recessions, people tend to cut back on discretionary expenses, including ride-hailing services. If users start opting for public transport or shared rides instead of Uber, it could reduce demand significantly.

Why it’s a threat? When the economy struggles, fewer people can afford premium services like UberX or UberBlack, leading to lower ride volume and revenue losses. Additionally, if businesses reduce corporate travel, it affects Uber’s high-value business customers. Economic downturns also lead to higher unemployment, meaning fewer people can afford Uber rides. This way, preferences shift to cheaper transportation options.

During the COVID-19 pandemic, Uber’s ride-bookings dropped by 75%, proving how vulnerable the company is to global economic shocks.

4. Rising Fuel Prices & Operational Costs

Uber relies on millions of independent drivers who use their personal vehicles to offer rides. When fuel prices rise, drivers face higher operating costs, making ride-hailing less profitable for them. If fares don’t increase, drivers may leave the platform, leading to a shortage of available rides.

Why it’s a threat? If fuel prices remain high for extended periods, Uber faces two bad options:

- Increase fares, which might push customers toward cheaper competitors or public transport.

- Absorb the costs by offering fuel subsidies to drivers, further reducing Uber’s profit margins.

This also affects UberEats, as delivery drivers (especially those using motorcycles and scooters) are also impacted by rising fuel expenses.

In 2022, Uber introduced temporary fuel surcharges in some regions to help drivers offset fuel costs, but if fuel prices continue rising, long-term financial strain is inevitable.

Summing Up

Initially a simple ride-hailing service, Uber has evolved into a global mobility giant.

With operations in over 70 countries and 10,000+ cities, Uber has revolutionized urban transportation, food delivery, and logistics, serving millions of riders and drivers daily.

Its ecosystem—spanning Uber Rides, Uber Eats, Uber Freight, and autonomous vehicle research—continues to reshape industries, while its investments in AI and automation drive efficiency and innovation.

Uber’s SWOT analysis reveals its:

- Unmatched strengths in global reach, brand dominance, data-driven operations, and service diversification.

- Key weaknesses, including ongoing profitability concerns, regulatory challenges, and driver dissatisfaction.

- Growth opportunities in AI-powered automation, emerging markets, and the rise of delivery services.

- Threats from competition, legal restrictions, and economic instability, which demand strategic adaptability.

Uber’s future success depends on how well it balances innovation, regulation, and profitability while expanding into new markets and autonomous technologies. Staying ahead in the evolving mobility landscape will require financial resilience, regulatory adaptability, and continued technological advancements.

Leave a Comment