Boeing, one of the world’s leading aerospace companies, dominates the aviation industry with its commercial airplanes, defense systems, and space exploration ventures.

Founded in 1916, Boeing has consistently innovated and expanded its market presence. However, like any other global company, it faces challenges in maintaining a competitive edge across different product lines.

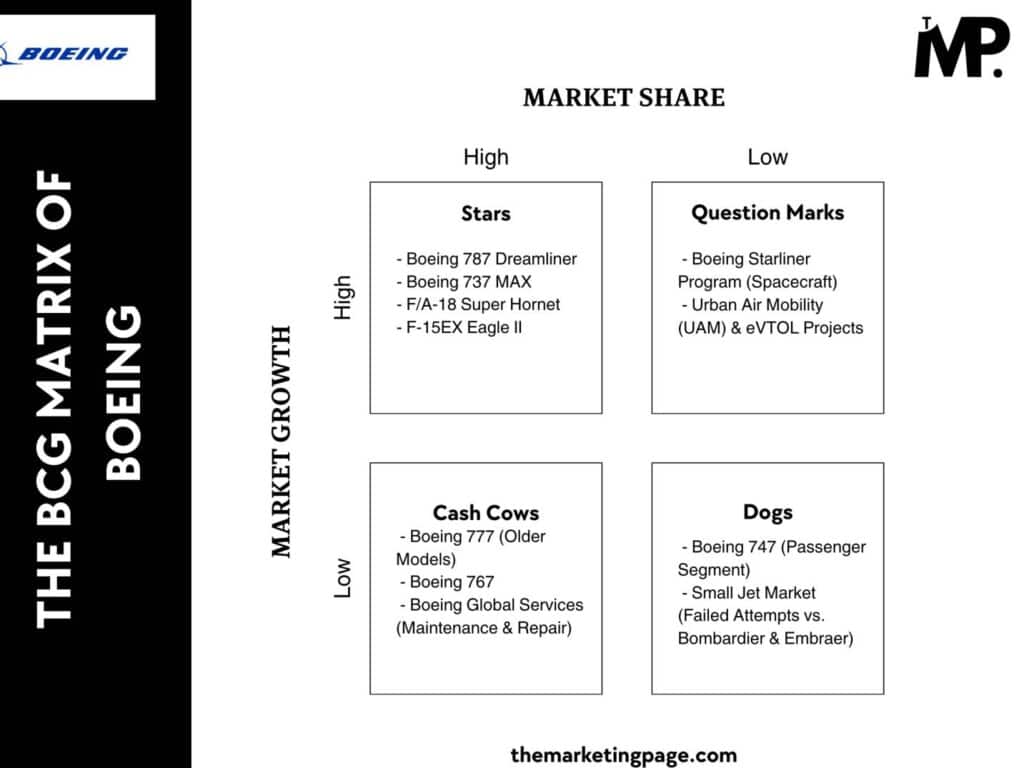

This is where the BCG Matrix helps in understanding Boeing’s business units and their performance.

BCG Matrix of Boeing

1. Stars (High Market Share, High Market Growth)

These are Boeing’s most promising business units that are contributing significantly to revenue.

Boeing Commercial Airplanes (BCA) i.e. advanced Models like 787 Dreamliner and 737 MAX remain high in demand, despite past challenges. Boeing had 774 commercial aircraft deliveries in 2023 which shows a strong post-pandemic recovery as airlines ramp up purchases.

- The 737 MAX remains in high demand, despite previous setbacks, due to fuel efficiency and cost-effectiveness.

- The 787 Dreamliner revolutionized long-haul flights with its advanced aerodynamics and composite structure.

Boeing’s defense sector is booming, driven by rising global military spending and strong U.S. government contracts.

Boeing Defense, Space & Security (BDS) i.e. advanced Fighter Jets & Defense Contracts like F/A-18 Super Hornet and F-15EX Eagle II (one of the most advanced fighter jets) are key U.S. defense assets. These contracts with the U.S. government and allies keep this unit thriving.

2. Cash Cows (High Market Share, Low Market Growth)

Cash cows are Boeing’s established business units that generate consistent revenue with minimal investment needs.

Despite being older, the Boeing 777 (Emirates being the largest operator) and Boeing 767 remain widely used by airlines for their proven reliability. Boeing still receives bulk orders for cargo and freighter variants, making these models long-term cash generators

Boeing Global Services (BGS) i.e. maintenance, repair, and support services for airlines worldwide are also considered to be cash cows. Airlines prefer long-term contracts with Boeing for servicing which ensures that they have predictable revenue streams.

Aftermarket services are a goldmine, often more profitable than manufacturing new planes.

3. Question Marks (Low Market Share, High Market Growth)

These are Boeing’s divisions that have high growth potential but currently hold low market share.

Boeing’s Starliner (competing with SpaceX’s Crew Dragon) has faced delays and cost overruns—harming its market share. The space tourism and satellite market is growing, but Boeing struggles to keep up with private competitors like SpaceX and Blue Origin. NASA has given Boeing contracts, but technical failures have hurt its reputation.

Read this: NASA switches Starliner crew to SpaceX Dragon as testing continues on troubled Boeing capsule

Electric vertical takeoff and landing (eVTOL) aircraft are the future of urban transport, but Boeing’s presence is weak compared to Joby Aviation. Regulatory approval challenges slow down market adoption.

While demand is expected to grow, Boeing has yet to establish a dominant position.

4. Dogs (Low Market Share, Low Market Growth)

Dogs are Boeing’s underperforming business segments with low market growth and low market share.

The iconic Boeing 747’s passenger variant was discontinued in 2023 after decades of service. Airlines prefer twin-engine, fuel-efficient models like the 787 Dreamliner, which offer lower operational costs. Demand for four-engine aircraft has plummeted which makes the 747 obsolete.

Moreover, Boeing’s attempts to enter the small jet market were unsuccessful. Regional jet makers Bombardier and Embraer dominate the sector, leaving no room for Boeing’s expansion. Boeing has shifted focus to large aircraft and defense projects, abandoning small jet development.

Final Thoughts

Boeing’s BCG Matrix reveals a smart mix of steady revenue and high growth opportunities.

- Stars (Next-Gen Aircraft & Defense Contracts) are Boeing’s powerhouses. Investing in these ensures long-term dominance.

- Cash Cows (Legacy Aircraft & Services) keep the cash flowing. These tried-and-true segments support innovation and expansion.

- Question Marks (Space Ventures & eVTOL) have potential but need direction. Strategic investments can turn them into future Stars.

- Dogs (Aging Aircraft & Small Jets) are fading out. Boeing is focusing on more lucrative and future-ready markets.

Note: It’s important to note that this analysis represents a limited snapshot in considered factors (market share and market growth) and time (2025).

Leave a Comment