The tech industry is constantly evolving, with new innovations and products emerging at a rapid pace.

For companies like Sony, staying ahead means knowing which products are thriving in the market.

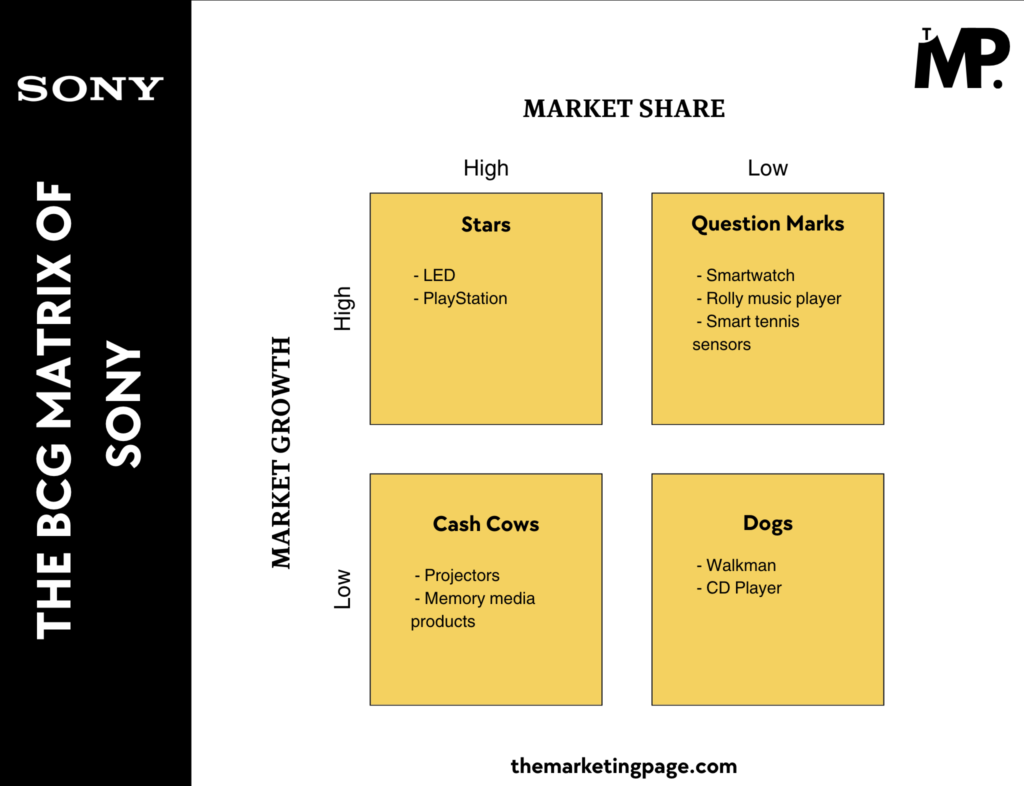

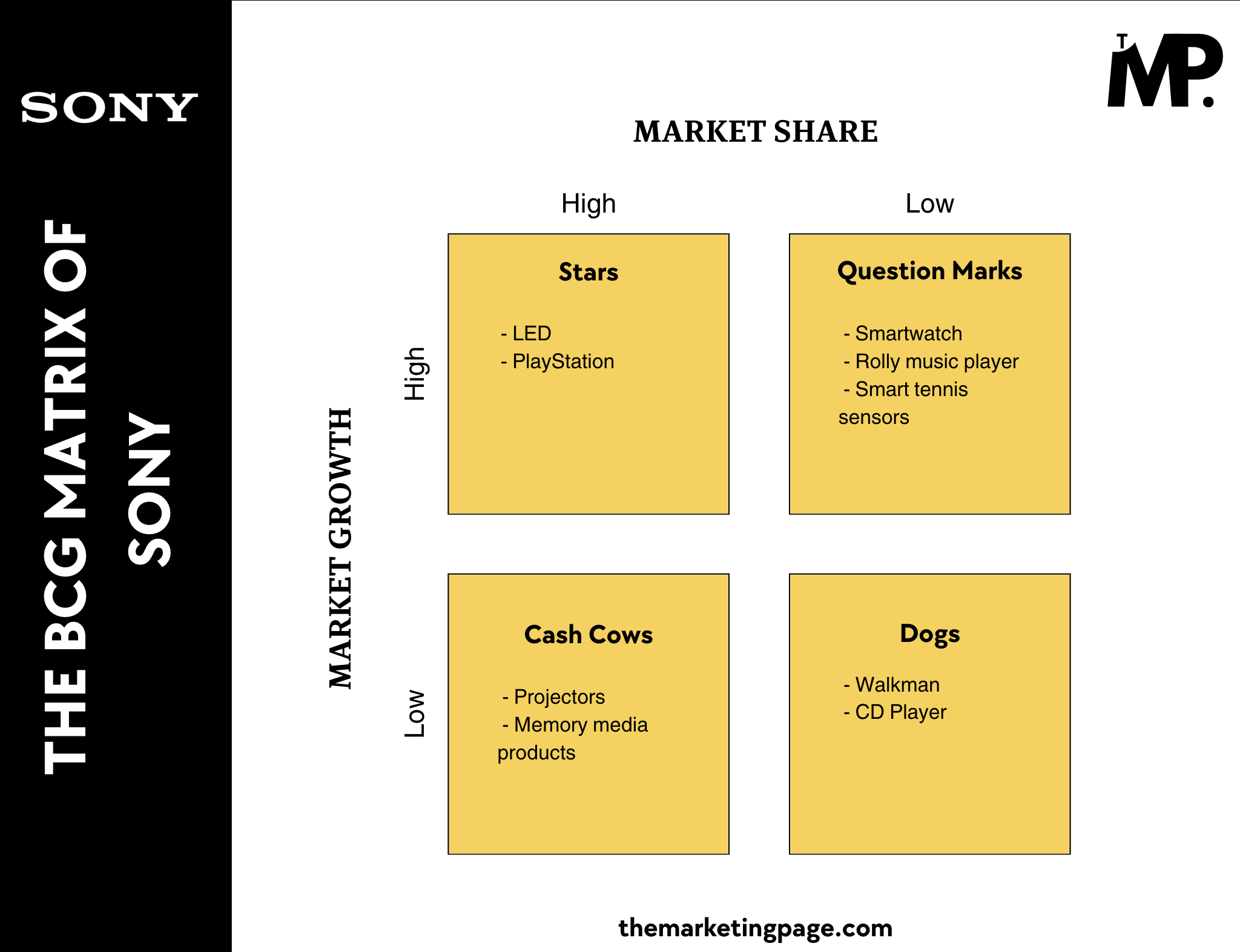

The BCG Matrix offers a powerful way to evaluate Sony’s diverse product lines—like gaming consoles, televisions, and audio equipment.

By applying the BCG Matrix, Sony can categorize its products into four key groups:

- Stars

- Cash Cows

- Question Marks

- Dogs.

This analysis helps Sony identify which products are leading the market, which are stable, and which may need a shift in strategy.

Overview of Sony

Sony is a leading global conglomerate known for its innovative technology, entertainment products, and diverse service offerings. Founded in 1946 in Tokyo, Japan, Sony has evolved into a prominent player in various industries like consumer electronics, gaming, film, and music. The company competes with major brands like Canon, Apple, and Samsung, maintaining a strong presence in over 204 countries.

Sony’s extensive product portfolio includes cutting-edge electronics such as televisions, cameras, and audio equipment, as well as popular gaming consoles like the PlayStation. Additionally, Sony is a powerhouse in the entertainment sector, producing films, TV shows, and music that resonate with audiences worldwide.

Under the leadership of CEO Kenichiro Yoshida, Sony continues to focus on innovation, sustainability, and expanding its global market reach. In 2024, the company reported revenue of $87.21 billion and a net income of $6.697 million.

Now, let’s explore how Adidas’ diverse product range fits into the BCG Matrix to evaluate their market positions and growth potential.

BCG Matrix Analysis of Sony

The BCG Matrix provides a clear snapshot of Sony’s product portfolio which helps in identifying which products are driving growth, generating cash, or facing challenges in the market.

Here’s how Sony’s major products fit into the BCG Matrix in 2024:

1. Stars (High Market Share, High Market Growth)

Key Products: LED and PlayStation

Sony’s LED televisions and PlayStation consoles are industry-leading products, thriving in high-demand, high-growth markets, placing them in the Star category.

The PlayStation line, particularly with the PlayStation 5, continues to dominate the gaming industry with advanced features and a large user base.

Sony’s LED TVs are also widely recognized for their superior picture quality and innovation, allowing them to maintain a stronghold in the growing entertainment tech market.

2. Cash Cows (High Market Share, Low Market Growth)

Key Products: Projectors and Memory Media Products

Sony’s projectors and memory media products, although in more mature markets with slower growth, provide steady and reliable revenue for the company.

The projector line is well-established in both consumer and professional sectors, making it a dependable revenue stream.

Memory media, including SD cards and storage solutions, continues to hold a significant market share, despite limited growth opportunities, positioning them as Cash Cows in the BCG Matrix.

3. Question Marks (Low Market Share, High Market Growth)

Key Products: Smartwatch, Rolly music player, and Smart Tennis Sensors

The smartwatch sector, dominated by brands like Apple and Samsung, shows promise but requires Sony to enhance its market position.

Similarly, innovative products like the Rolly and Smart Tennis Sensors appeal to niche markets but haven’t yet gained the widespread adoption needed to capitalize on their high-growth potential, making them Question Marks.

4. Dogs (Low Market Share, Low Market Growth)

Key Products: Walkman and CD player

Once revolutionary products, Walkman and CD players have struggled to remain relevant in today’s digital age, now sitting in low-growth, low-market-share categories.

With advancements in streaming and portable music devices, these products have been surpassed by modern alternatives.

Similarly, Sony’s robotic ventures, which once held potential, haven’t managed to secure a strong market position, leading them to fall into the Dog category, with limited future growth opportunities.

Concluding the Analysis

In summary, Sony’s product portfolio showcases a mix of high-performing and underperforming products.

- PlayStation and LED TVs lead in high-growth markets, securing strong positions.

- Mature products like projectors and memory media remain steady sources of revenue but face limited market growth.

- Emerging products, such as smartwatches, hold potential but require stronger market presence.

- Meanwhile, outdated technologies like the Walkman and CD player have lost relevance.

To stay competitive, Sony must focus on expanding in growth markets while reassessing or retiring weaker products.

It’s important to note that this analysis represents a limited snapshot in considered factors (market share and market growth) and time (2024).

1 Comment