Adidas is a global leader in sportswear, known for its innovative products and strong brand presence.

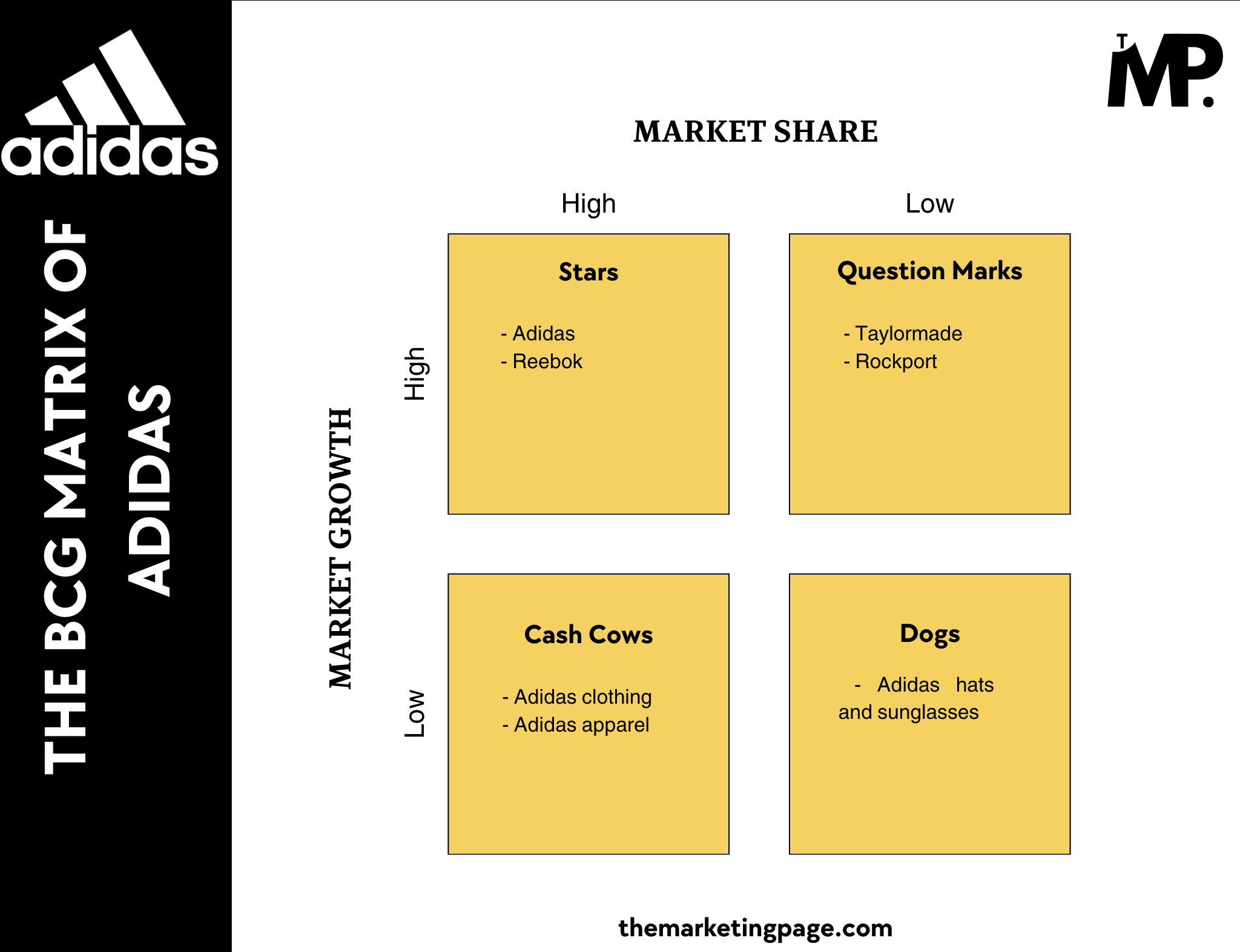

The BCG Matrix helps us assess Adidas’s product portfolio by considering market share and growth potential.

This analysis enables the company to strategically allocate resources and focus on high-growth items while maintaining the stability of established products.

Overview of Adidas

Adidas is one of the world’s leading sportswear brands, known for its high-quality athletic apparel, footwear, and accessories. Founded in 1949, Adidas has grown into a global powerhouse in the sports and lifestyle industries, competing with major players like Nike and Puma. The company is recognized for its innovative product designs, sustainability initiatives, and collaborations with top athletes (Leo Messi, Mohamed Salah, Paulo Dybala).

Adidas’ product portfolio includes iconic footwear such as the Ultraboost and Stan Smith, performance apparel, and sports equipment. They cater to both professional athletes and casual consumers.

Under the leadership of CEO Bjorn Gulden, Adidas continues to prioritize innovation, sustainability, and market expansion. In 2024, the company generated $23.80 billion in revenue with a net income of $204.58 million.

Now, let’s explore how Adidas’ diverse product range fits into the BCG Matrix to evaluate their market positions and growth potential.

BCG Matrix Analysis of Adidas

In 2024, here’s how Adidas’s main products align within the BCG Matrix:

1. Stars (High Market Share, High Market Growth)

Key Products: Adidas, Reebok

Adidas and Reebok are key products in the Star category, both enjoying significant market share and high growth rates.

Adidas has successfully positioned itself as a key player globally with billions in revenue and a dominant market share.

By consistently innovating in performance footwear and apparel, it continues to see high demand.

The introduction of Boost technology, collaborations, and strategic marketing keeps it firmly in the growth zone.

Reebok, while a subsidiary, is a force in its own right.

The fitness trend is booming, and Reebok capitalizes on it by offering products that cater to this lifestyle.

2. Cash Cows (High Market Share, Low Market Growth)

Key Products: Adidas Clothing, Adidas Apparel

Adidas’ clothing line is a reliable profit generator, falling squarely in the Cash Cows category.

Adidas maintains a dominant presence in the global apparel market with sportswear staples like jerseys and activewear. However, the clothing sector is reaching maturity.

While growth is slower, the brand’s massive market share ensures steady income.

Although this sector lacks the rapid growth of newer markets, it provides a steady cash flow that supports other parts of the business.

3. Question Marks (Low Market Share, High Market Growth)

Key Products: TaylorMade, Rockport

Rockport might not have a massive market share, but its growth potential is undeniable.

Known for comfort-oriented footwear, Rockport is tapping into the expanding demand for stylish, comfortable shoes. Yet, it faces tough competition from brands like Nike and Adidas in the broader footwear space.

Despite this, the brand’s revenue of $600 million in 2023 indicates significant potential for growth.

TaylorMade is a Question Mark—its potential is high, but its market share is not yet dominant.

In the golf industry, TaylorMade competes against well-established giants like Titleist and Callaway.

However, as golf continues to grow in popularity, TaylorMade’s focus on high-tech equipment and premium products positions it for future success. In 2023, it generated $2 billion in revenue.

Both brands show promise but require strategic investment to increase their market presence.

4. Dogs (Low Market Share, Low Market Growth)

Key Products: Adidas hats and sunglasses

Adidas hats and sunglasses are classic examples of Dogs in the BCG Matrix.

Despite being a part of the Adidas portfolio, these accessories barely make a dent in the fashion and lifestyle market. Competition from specialized accessory brands is fierce, and the growth rate for these products is stagnant.

Adidas’ accessory segment contributes less than 2% of the company’s total revenue. Thiss it clear that these products are not contributing significantly to the bottom line.

It’s a classic Dog—small share, low growth

Concluding the Analysis

In conclusion,

Adidas’ BCG Matrix analysis shows that its core brands, Adidas and Reebok, are leading Stars with strong market growth.

The clothing and apparel segment serves as a stable Cash Cow, ensuring reliable revenue.

TaylorMade and Rockport, categorized as Question Marks, present potential for growth but require strategic investment.

Meanwhile, hats and sunglasses, considered Dogs, offer limited growth opportunities.

To maintain balance, Adidas should focus on its high-performing products while carefully deciding the future of underperforming areas.

It’s important to note that this analysis represents a limited snapshot in considered factors (market share and market growth) and time (2024).

Leave a Comment