TSMC, the world’s leading semiconductor manufacturer, plays a pivotal role in shaping the global tech landscape.

With products ranging from cutting-edge integrated circuits to multi-wafer foundry services, the company drives innovation across industries like AI, IoT, and automotive.

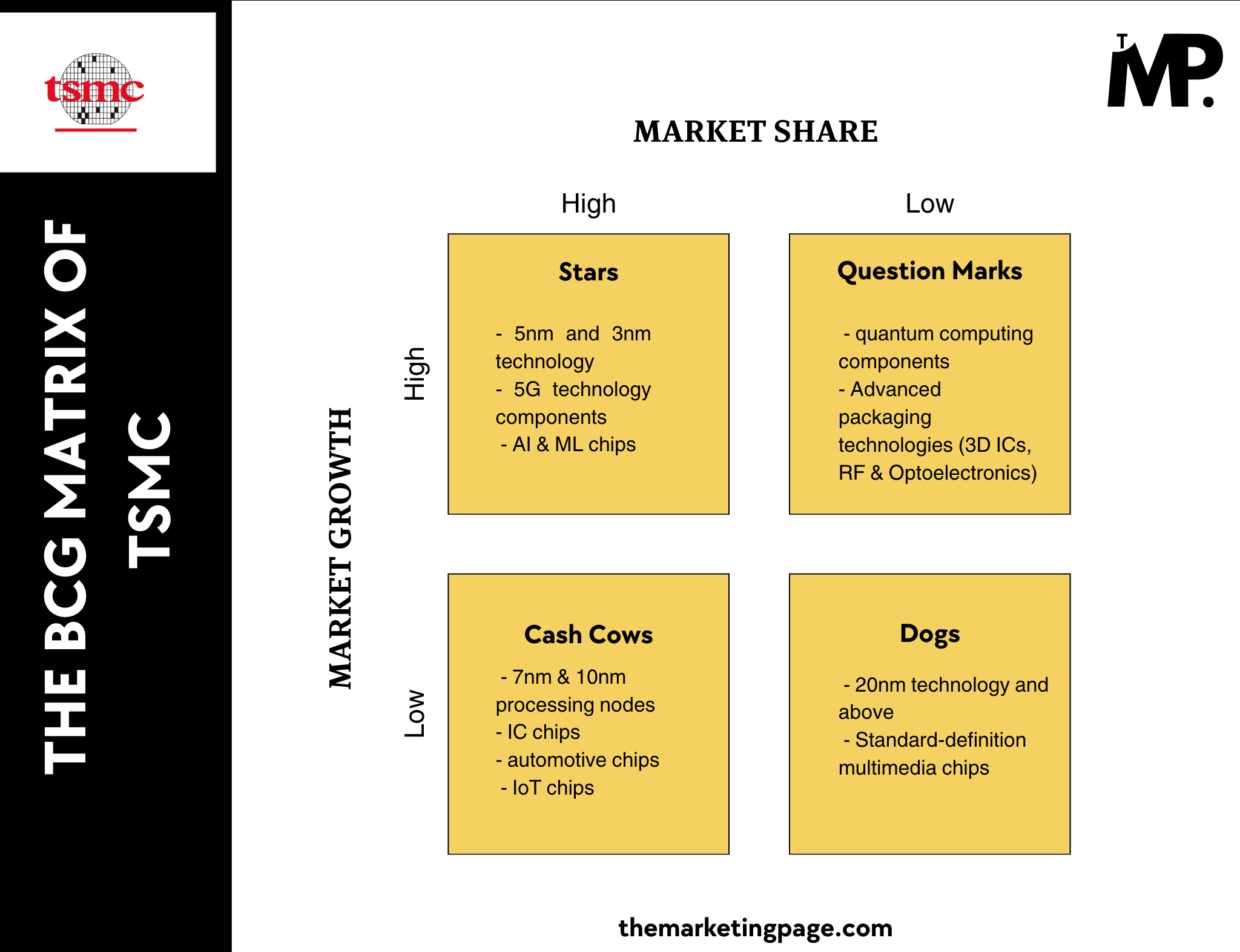

The BCG Matrix provides a strategic framework to categorize TSMC’s diverse offerings into;

- Stars

- Cash Cows

- Question Marks

- Dogs

based on market growth and share.

Overview of TSMC

Taiwan Semiconductor Manufacturing Company Limited (TSMC) stands as a global leader in the semiconductor industry, renowned for its advanced integrated circuits, mask services, and multi-wafer foundry solutions. Established in 1987, the company has grown into a public entity operating across six countries, employing over 76,478 people as of FY2024. With an impressive revenue of 2.9 trillion and a net income of 325.26 billion, TSMC powers innovations for industries ranging from automotive to AI and IoT. Competing with giants like Samsung Foundry, Intel, and AMD, TSMC’s dominance stems from its cutting-edge technology and reliable services that cater to global tech leaders.

Strategic initiatives drive TSMC’s continued success. The company invests heavily in R&D to develop advanced 3nm and 2nm nodes, ensuring it stays ahead in semiconductor innovation. TSMC is also addressing geopolitical risks by constructing new fabrication plants in Arizona and Japan, while committing to net-zero emissions by 2050 with sustainable manufacturing practices. Collaborations with major clients such as Apple, NVIDIA, and AMD solidify its position, while ventures into emerging markets like automotive, AI, and IoT chips highlight its growth strategy. With increased production capacity and workforce innovation, TSMC is poised to meet rising global semiconductor demand.

BCG Matrix of TSMC

1. Stars (High Market Share, High Market Growth)

TSMC’s 5nm and 3nm nodes are at the forefront of semiconductor innovation. These nodes are delivering unmatched performance and energy efficiency. These technologies are highly sought after by leading brands like Apple and NVIDIA, ensuring strong demand in high-growth markets such as advanced computing and mobile devices.

TSMC plays a pivotal role in manufacturing chips essential for 5G networks. As global adoption of 5G accelerates, the demand for TSMC’s expertise and capabilities continues to rise, positioning it as a leader in this booming sector.

The rise of artificial intelligence and machine learning has driven exponential demand for specialized hardware. TSMC’s AI & ML chips power AI training models and edge devices, making this segment a critical driver of its future growth.

2. Cash Cows (High Market Share, Low Market Growth)

7nm & 10nm processing nodes have become industry standards for mainstream applications, generating stable revenue. With lower R&D costs compared to newer technologies, they remain highly profitable for TSMC.

Integrated circuit chips is TSMC’s bread and butter. It consistently provides a steady revenue stream by catering to a wide range of industries, from consumer electronics to industrial applications.

TSMC is a trusted partner for IoT chip production, benefiting from the continuous expansion of smart devices. The relatively low market growth ensures consistent, predictable profits.

With growing demand for electric and autonomous vehicles, TSMC’s automotive chips dominate a stable market segment, offering high reliability and long-term revenue potential.

3. Question Marks (Low Market Share, High Market Growth)

While quantum computing has immense potential, it remains in its infancy. TSMC is investing in quantum computing components space, but market adoption and profitability are still uncertain.

TSMC is exploring Advanced packaging technologies (3D ICs, RF & Optoelectronics) to boost chip performance. These solutions hold promise, but their long-term market viability and profitability are not guaranteed.

4. Dogs (Low Market Share, Low Market Growth)

Legacy nodes like 20nm no longer meet modern performance demands, making them obsolete. These outdated technologies contribute minimally to TSMC’s revenue and are being phased out.

As technology shifts towards ultra-high definition (UHD) and beyond, standard-definition multimedia chips have lost relevance, contributing little to TSMC’s overall growth.

Summing up

In conclusion, TSMC’s BCG Matrix showcases its strategic strength and adaptability:

- Stars: Innovations like 5nm and 3nm nodes, AI, and 5G technologies drive growth in high-demand markets.

- Cash Cows: Stable revenue comes from 7nm nodes, IC fabrication, IoT chips, and automotive solutions.

- Question Marks: Emerging investments in quantum computing and advanced packaging hold future potential.

- Dogs: Legacy technologies like 20nm nodes and outdated multimedia products contribute minimally.

TSMC’s balanced approach ensures sustained leadership in the semiconductor industry.

1 Comment