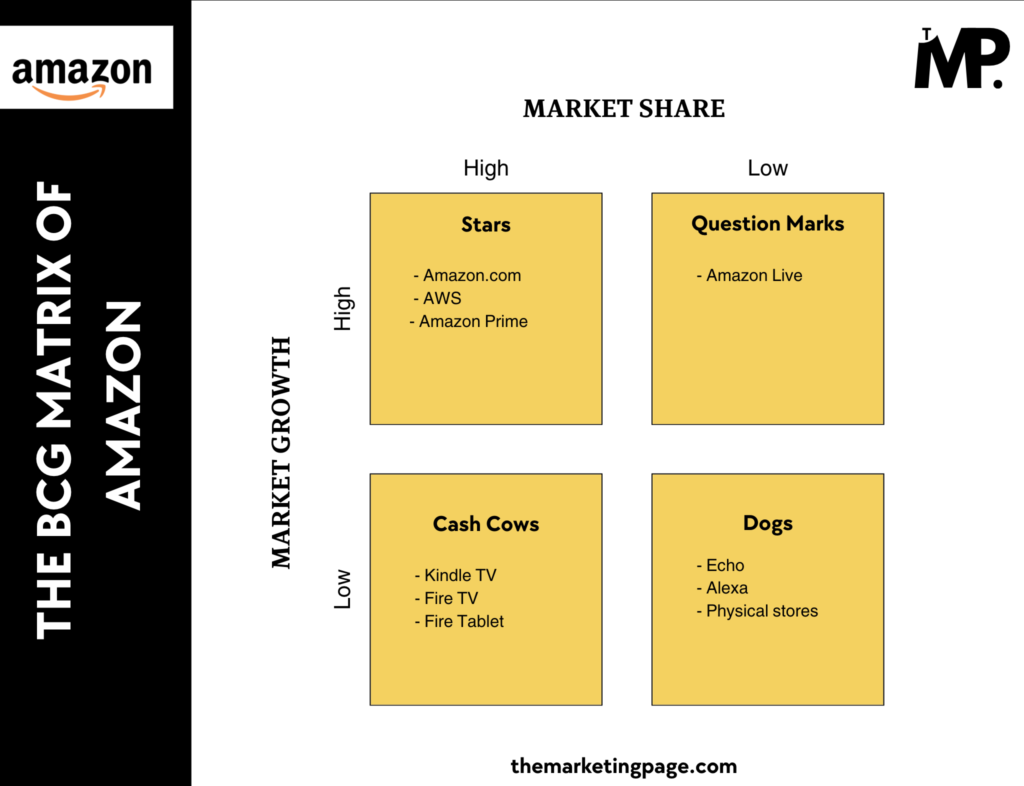

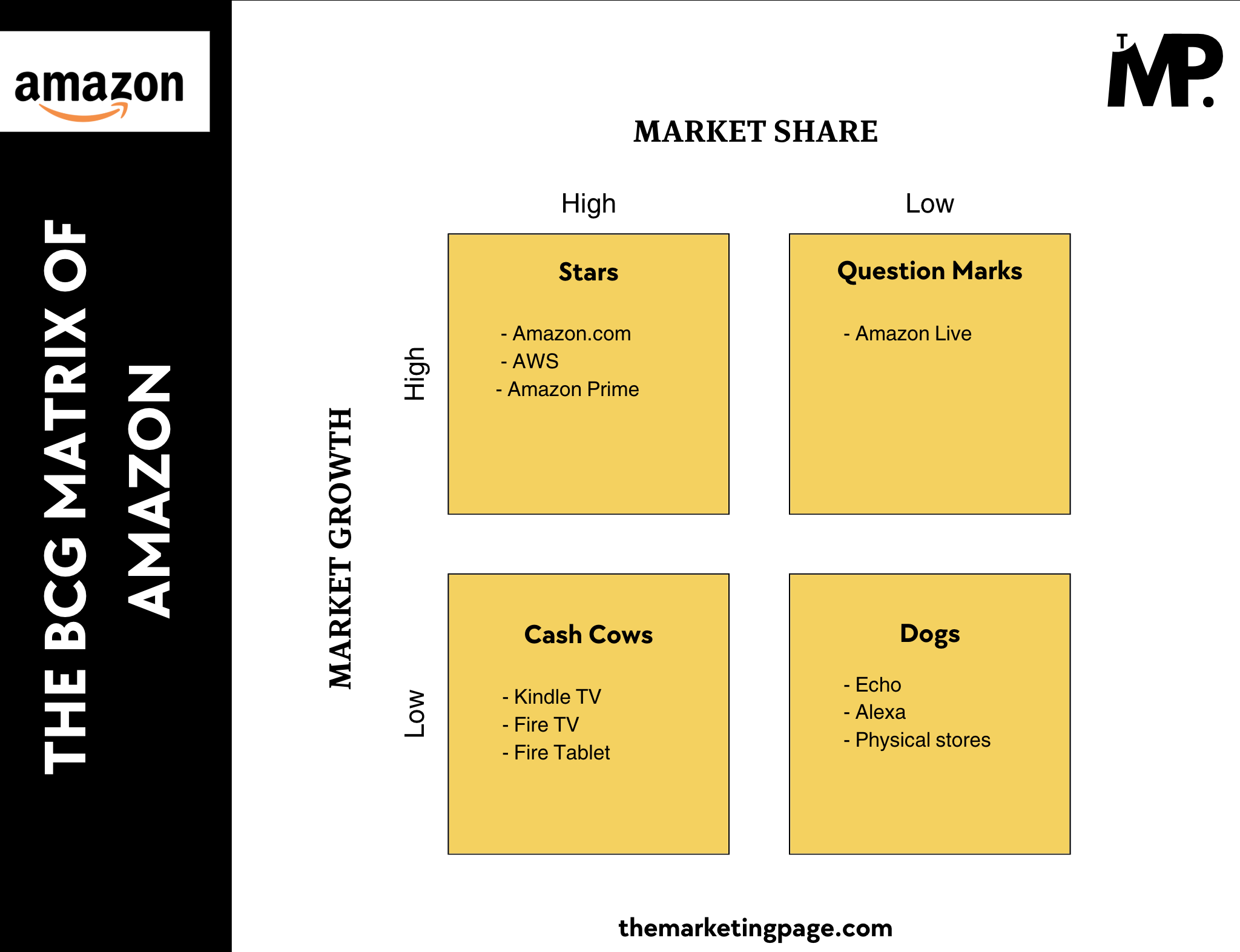

The BCG Matrix is a business framework for smart decision-making which marketers can also use to derive conclusions. Because it is portfolio analysis method which evaluates a company’s products or business units based on market growth and relative market share.

This framework can be applied to a giant like Amazon.

Let’s see how.

Overview of Amazon

Amazon.com, Inc. is one of the world’s largest and most influential technology and e-commerce companies. Founded in 1994 by Jeff Bezos, the company began as an online bookstore and has since evolved into a global leader in various sectors, including retail, cloud computing, digital streaming, and artificial intelligence.

Today, Amazon operates in over 20 countries and employs approximately 1.5 million people (FY2023). Its diverse portfolio includes well-known products and services such as Amazon.com, Amazon Prime, Amazon Web Services (AWS), Alexa, Kindle, Fire TV, and various physical retail stores.

Financially, Amazon generated $574.78 billion in revenue for FY2023, with a net income of $30.425 billion. Under the leadership of President and CEO Andy Jassy and Executive Chairman Jeff Bezos, Amazon continues to innovate and expand its offerings, solidifying its position as a dominant force in technology and e-commerce.

BCG Matrix Analysis of Amazon

The BCG Matrix provides a clear snapshot of Amazon’s product portfolio which helps in identifying which products are driving growth, generating cash, or facing challenges in the market.

Here’s how Amazon’s major products fit into the BCG Matrix in 2024:

1. Stars (High Market Share, High Market Growth)

Key Products: Amazon.com, AWS, Amazon Prime

Amazon’s Amazon.com stands out as a dominant player in the e-commerce market. It is exhibiting strong growth potential alongside its significant market share. The platform continues to attract millions of customers globally, consistently expanding its product offerings.

Similarly, Amazon Web Services (AWS) has emerged as a leader in the cloud computing space, generating substantial revenue while demonstrating rapid growth.

Another key player in this quadrant is Amazon Prime, a subscription service that is consistently growing its member base and contributing positively to Amazon’s overall performance.

2. Cash Cows (High Market Share, Low Market Growth)

Key Products: Kindle, Fire TV, Fire Tablet

The Kindle e-reader has established a strong position in the e-book market, generating steady revenue despite experiencing limited growth opportunities.

Additionally, the Fire Tablet holds a significant market share, providing reliable income while its growth has stabilized.

Fire TV remains a dominant streaming device in households. It is maintaining a strong presence in the market with consistent earnings, albeit with low growth prospects in the saturated streaming device market.

3. Question Marks (Low Market Share, High Market Growth)

Key Products: Amazon Live

Amazon Live is categorized as a question mark because it operates in a rapidly growing market for live-streaming commerce, but it currently holds a low market share. While this service allows brands to connect with consumers, it has yet to establish a significant foothold compared to its competitors. Amazon Live has the potential for substantial growth if the company invests strategically in it.

4. Dogs (Low Market Share, Low Market Growth)

Key Products: Echo, Alexa, and Physical Stores

In the Dogs quadrant, both Echo and Amazon Alexa are products that face significant challenges due to intense competition. It results in stagnant growth and declining market share.

Amazon’s physical stores, including Amazon Go and Whole Foods, have struggled to gain substantial market presence in the competitive retail landscape.

Concluding the Analysis

In conclusion, Amazon’s diverse portfolio of products and services showcases a strategic mix of offerings that are positioned across different quadrants of the BCG matrix.

The Stars—Amazon.com, AWS, and Amazon Prime—illustrate the company’s strengths in e-commerce and cloud computing, driving robust growth and profitability.

The Cash Cows—Kindle, Fire Tablet, and Fire TV—continue to deliver steady revenue streams, reflecting their established market positions.

The Question Marks such as Amazon Live and Fire OS represent potential growth areas that require careful investment and strategic focus to capitalize on emerging trends.

The Dogs—Echo, Amazon Alexa, and physical stores—highlight challenges within competitive markets where growth is stagnant and market share is limited.

It’s important to note that this analysis represents a limited snapshot in considered factors (market share and market growth) and time (2024).

1 Comment