The BCG Matrix is a strategic tool that helps companies analyze their product portfolio based on two factors:

- Market growth

- Market share.

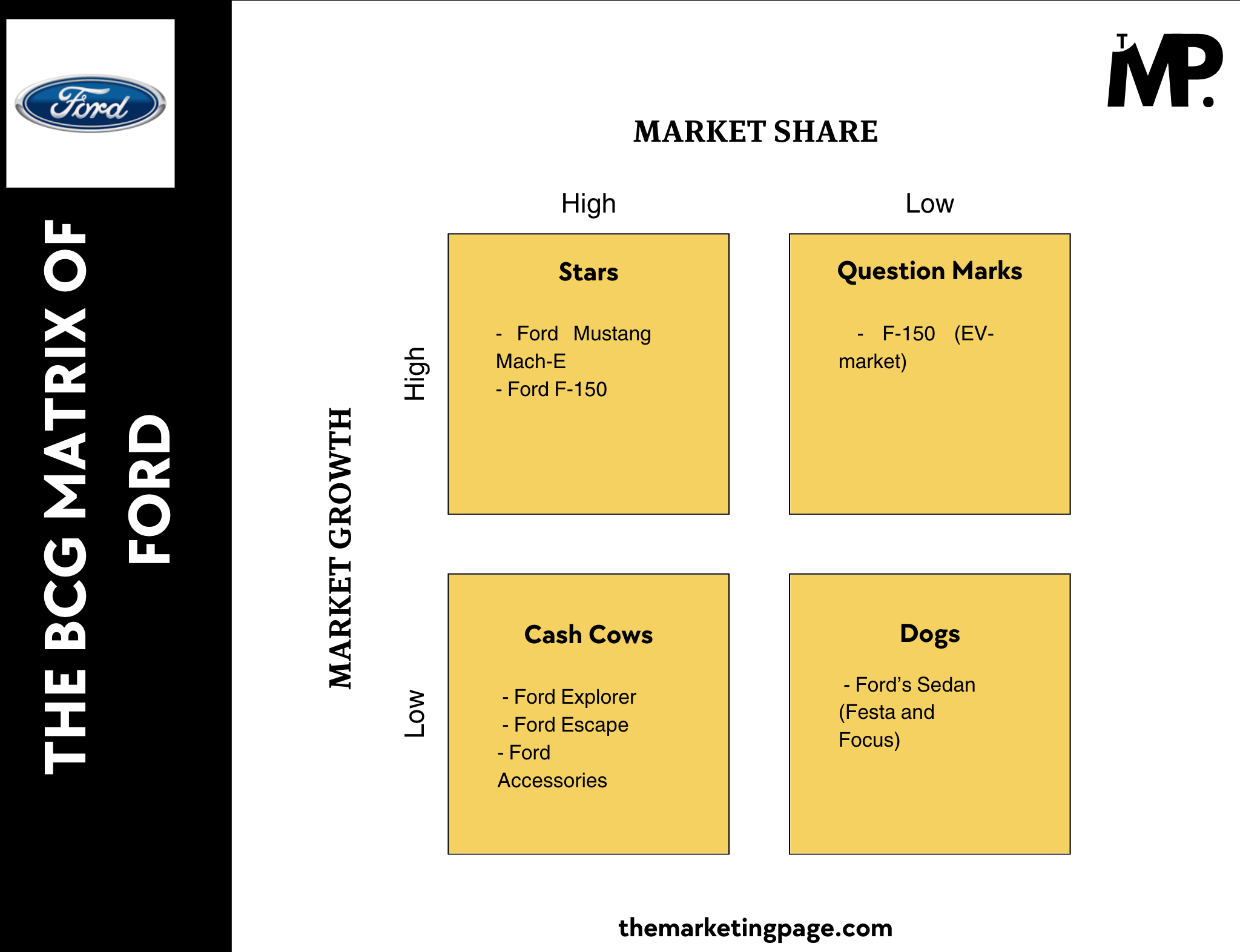

In the competitive automotive industry, the BCG Matrix allows companies like Ford to evaluate the performance of their wide range of vehicles. Ford can classify it’s products into four categories—Stars, Cash Cows, Question Marks, and Dogs— to make smarter investing decisions.

Overview of Ford

Ford Motor Company is a globally recognized leader in the automotive industry, known for its innovative vehicles. Founded in 1903 in Detroit, Michigan, Ford has played a pivotal role in shaping the global automotive landscape, with a presence in over 125 countries. The company competes with major brands like Toyota, Tesla, and General Motors, offering a wide range of vehicles from trucks and SUVs to luxury and commercial models.

Ford’s iconic product lineup includes the F-Series trucks, the Mustang, and its growing range of electric vehicles like the Mustang Mach-E and F-150 Lightning. In addition to traditional vehicles, Ford is increasingly focused on future mobility solutions, including electric and autonomous vehicles, as part of its broader sustainability and innovation goals. This commitment aligns with its strategic shift toward reducing carbon emissions and promoting green technologies.

Under the leadership of Executive Chairman William Clay Ford Jr. and CEO Jim Farley, Ford continues to prioritize electric vehicle development, mobility services, and advanced technologies. In 2023, the company generated $176.2 billion in revenue and $4.33 billion in net income.

Now, let’s explore how Ford’s diverse product range fits into the BCG Matrix to evaluate their market positions and growth potential.

BCG Matrix of Ford

The BCG Matrix provides a clear snapshot of Ford’s product portfolio which helps in identifying which products are driving growth, generating cash, or facing challenges in the market.

Here’s how Apple’s major products fit into the BCG Matrix in 2024:

1. Stars (High Market Share, High Market Growth)

The Ford Mustang is a classic icon, and it continues to capture significant market share, especially with its performance and stylish appeal. The Mustang is in a high-growth phase, thanks to its success in the muscle car segment and its expanding reach in global markets.

The Ford Mustang Mach-E marks a bold step for Ford as it enters the electric vehicle market with a high-performance SUV. Combining the Mustang’s brand appeal with cutting-edge electric technology, the Mach-E taps into the growing EV demand. Its ability to compete with established electric vehicles like Tesla’s Model Y positions the Mach-E as a “Star” product.

The Ford F-150 remains one of the best-selling vehicles in the U.S. and continues to lead the truck segment. Its success lies in its combination of power, reliability, and versatility. It caters to both work and lifestyle needs.

2. Cash Cows (High Market Share, Low Market Growth)

Ford’s SUV and truck models, such as the Ford Explorer and Escape, represent steady revenue generators for the company.

While these models have already captured a large share of their respective markets, growth is slow due to their maturity. These vehicles continue to bring in consistent profits, although the focus has shifted to newer, more innovative categories like electric vehicles.

Ford’s conventional gas-powered vehicles still play an important role in its portfolio, generating solid cash flow.

In areas where EV infrastructure is not well-established, gas-powered models remain in demand, ensuring profitability despite limited growth. Moreover, Ford’s parts and accessories business provides a stable income stream.

With a large number of vehicles on the road, these products, from batteries to custom parts, contribute significantly to Ford’s bottom line, despite little market expansion.

3. Question Marks (Low Market Share, High Market Growth)

The Ford Lightning, an all-electric version of the ever-popular F-150 truck, is still finding its place in the competitive EV market.

Although the demand for electric trucks is growing rapidly, Ford has not yet captured the same level of market share as competitors like Tesla and Rivian.

The Lightning’s future is filled with potential, and as the electric vehicle market continues to expand, the vehicle has significant room for growth.

However, its current position as a “Question Mark” highlights the uncertainty around whether Ford can compete with the established EV leaders in this emerging market.

4. Dogs (Low Market Share, Low Market Growth)

Ford’s smaller sedans, like the Fiesta and Focus, have struggled to maintain their position in the face of shifting consumer preferences.

As larger vehicles like SUVs and trucks become more popular, demand for compact sedans has dwindled, especially in key markets like the U.S.

With the rise of electric and larger vehicles, Ford has refocused its efforts on SUV and truck development, leaving smaller sedans with limited investment.

These vehicles now hold a minimal market share and face little growth potential, earning them the “Dog” label in Ford’s portfolio.

Conclusion

The BCG Matrix offers a valuable lens through which we can assess Ford’s diverse product portfolio, helping the company navigate its growth strategy. By categorizing its vehicles into Stars, Cash Cows, Question Marks, and Dogs, Ford gains a clearer understanding of where to focus resources.

- Stars like the Mustang Mach-E and F-150 are driving growth and innovation, while Cash Cows like the Explorerand Escape provide steady revenue.

- Question Marks like the Ford Lightning have high growth potential, but need more attention to increase market share.

- Dogs like the Fiesta and Focus may have limited growth, reflecting the changing preferences of consumers.

By evaluating its products using the BCG Matrix, Ford can make informed decisions on where to invest, innovate, and possibly phase out older models. This strategic approach will be crucial as they continue to navigate the evolving automotive market.

1 Comment