The BCG Matrix is an essential tool for analyzing a company’s product portfolio which helps to identofy which products are driving growth and generating steady income.

For Google, this framework reveals a mix of products that are not only dominating their respective markets but also holding potential for future growth.

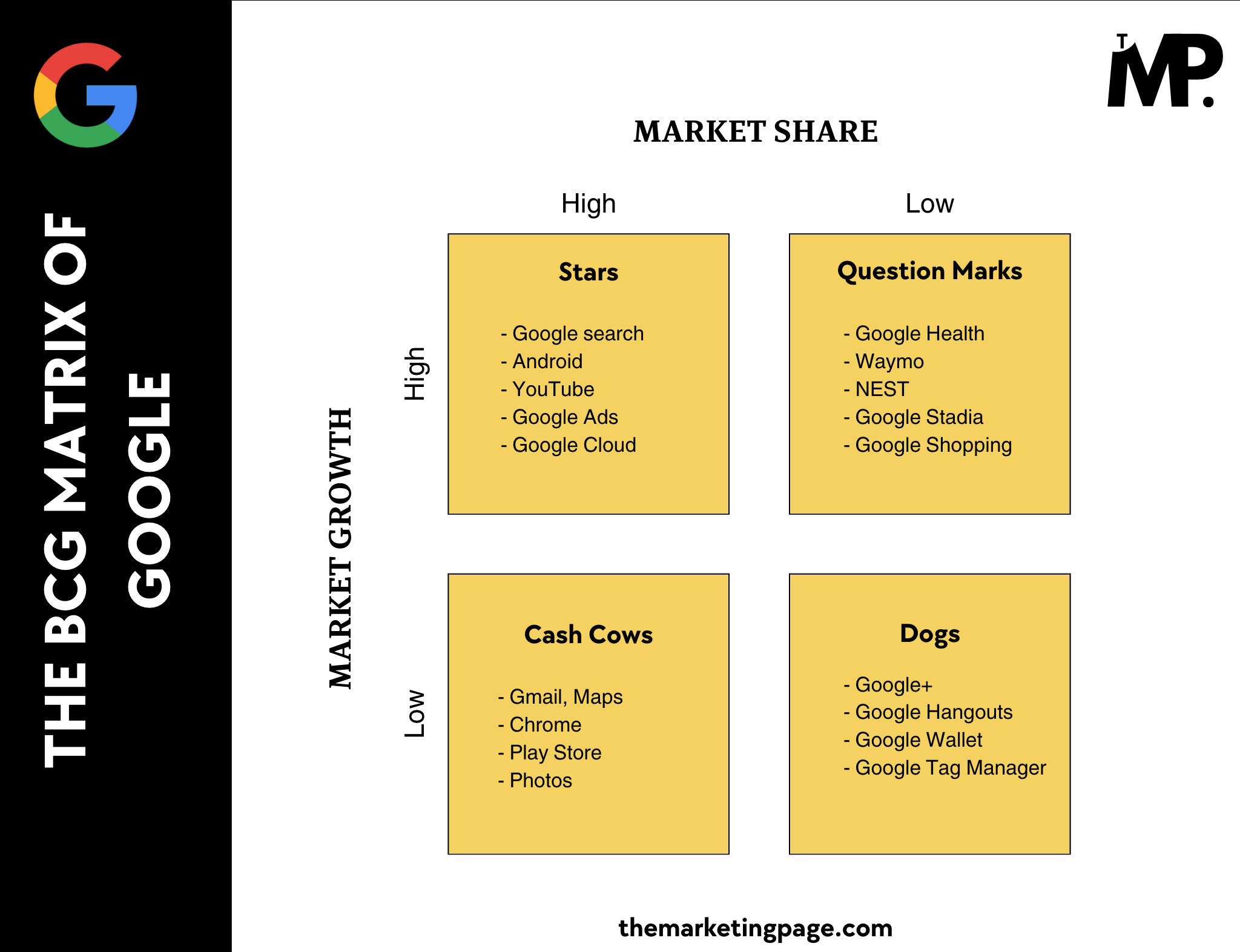

By categorizing products in the categories i.e.

- Stars

- Cash Cows

- Question Marks

- Dogs

Google can make more informed decisions across the portfolio.

Also Read: SWOT Analysis of Google Inc. [2024]

Overview of Google

Google is a leading global technology company renowned for its innovative products and services in internet search, advertising, and cloud computing. Founded in 1998 in Menlo Park, California, Google has evolved into a dominant player in various sectors, including artificial intelligence and consumer electronics, operating in over 219 countries worldwide.

The company is widely recognized for its flagship products, such as Google Search, YouTube, and the Android operating system, alongside a suite of tools and services like Google Ads, Google Cloud, and Google Workspace. These offerings cater to both individual consumers and businesses. This whole set of tools makes Google an integral part of daily digital experiences.

Under the leadership of CEO Sundar Pichai, Google continues to prioritize innovation, user experience, and responsible technology development. In 2024, the company reported an impressive revenue of $305.69 billion and a net income of $73.795 billion, solidifying its position as a powerhouse in the tech industry.

BCG Matrix of Google

Now, let’s explore how Google’s diverse product range fits into the BCG Matrix to evaluate their market positions and growth potential.

1. Stars (High Market Share, High Market Growth)

Google’s stars represent the company’s most profitable and fast-growing assets.

Key Products: Google search, Android, YouTube, Google Ads, Google Cloud

Google Search is the undisputed leader in online search with over over 90% of the global search engine market. As the world’s most popular mobile OS, Android powers over 2.5 billion devices globally. With the continuous rise of smartphones, it retains high market growth, especially in emerging markets.

YouTube remains the go-to platform for video content, streaming, and creator-driven revenue. It continues to expand with new features like YouTube Shorts.

Google Ads remains a key revenue generator, while Google Cloud is positioning itself as a strong competitor to AWS and Azure in the cloud services market, with its annual revenue surpassing $30 billion.

2. Cash Cows (High Market Share, Low Market Growth)

Google’s cash cows are products that have a dominant market presence but are in more mature markets with slower growth.

Key Products: Gmail, Maps, Chrome, Play Store, Photos

Gmail, with over 1.5 billion users, remains one of the most popular email services globally. The market for email service is mature. Even after this, its high user engagement and integration with other Google products maintain its profitability.

In mapping services, Google Maps holds a dominant position with over 1 billion users globally. As it’s growth has slowed, its utility in navigation and traffic updates ensures continued market leadership. It also caters to people who rely on business search.

Chrome continues to dominate as the most-used web browser, with a market share exceeding 65%. The Play Store remains a key revenue generator for Google through app sales, subscriptions, and in-app purchases.

Google Photos, with unlimited cloud storage for photos and videos, has gained widespread use. As photo storage becomes more ubiquitous, growth slows, but its dominance in the market ensures steady income through premium services.

3. Question Marks (Low Market Share, High Market Growth)

The question marks in Google’s portfolio have high growth potential but face significant competition and market uncertainties.

Key Products: Google Health, Waymo, NEST, Google Stadia, Google Shopping

Google Health’s growth potential lies in data-driven health solutions. Waymo is a leader in self-driving technology but faces regulatory and technical hurdles to widespread adoption. As autonomous vehicles become more viable, its market share could rise significantly, making it a promising future asset.

While NEST has made a strong entrance into the smart home industry, its competition with Amazon’s Alexa and other IoT devices is fierce. Its market share remains small, but the rise of smart home adoption could drive growth.

Stadia aimed to disrupt the gaming industry, offering cloud gaming. However, due to high competition and technical limitations, it struggled to achieve mainstream success, but gaming’s growth could lead to potential future success with changes.

Google Shopping aims to compete with Amazon in e-commerce but faces challenges in market penetration and competition. Despite this, the continued rise of online shopping could give it an opportunity for substantial growth with the right strategy

4. Dogs (Low Market Share, Low Market Growth)

Google’s “dogs” represent products that either failed to capture significant market share or are operating in shrinking markets.

Key Products: Google+, Google Hangouts, Google Wallet, Google Tag Manager

The “dogs” in Google’s portfolio include Google+. It was Google’s attempt at a social network, but it failed to compete with Facebook, Instagram, and Twitter. It was eventually shut down, and the social media landscape continues to evolve without Google+.

Google Hangouts, while initially popular, was overtaken by more specialized communication apps like Slack and Zoom. Its declining user base and lack of innovation led to its phase-out, making it a “dog” in Google’s portfolio.

Google Wallet struggled to gain traction against competitors like PayPal and Apple Pay. Google Tag Manager, though useful for marketers, has not seen widespread adoption in the broader analytics market, limiting its growth.

Conclusion

Google can prioritize investments in Stars (e.g., YouTube, Google Search) for continuous innovation. For Cash Cows, like Google Ads, the focus would be on maximizing profit with minimal additional investment. Question Marks, such as NEST, can receive extra attention to boost market share. Finally, Dogs, like Google+, may be phased out to redirect resources to higher-potential products.

You are my inspiration , I possess few blogs and rarely run out from to brand.