Meta Platforms, a powerhouse in the social media and tech industry, has a diverse portfolio which makes it stay ahead in the competition.

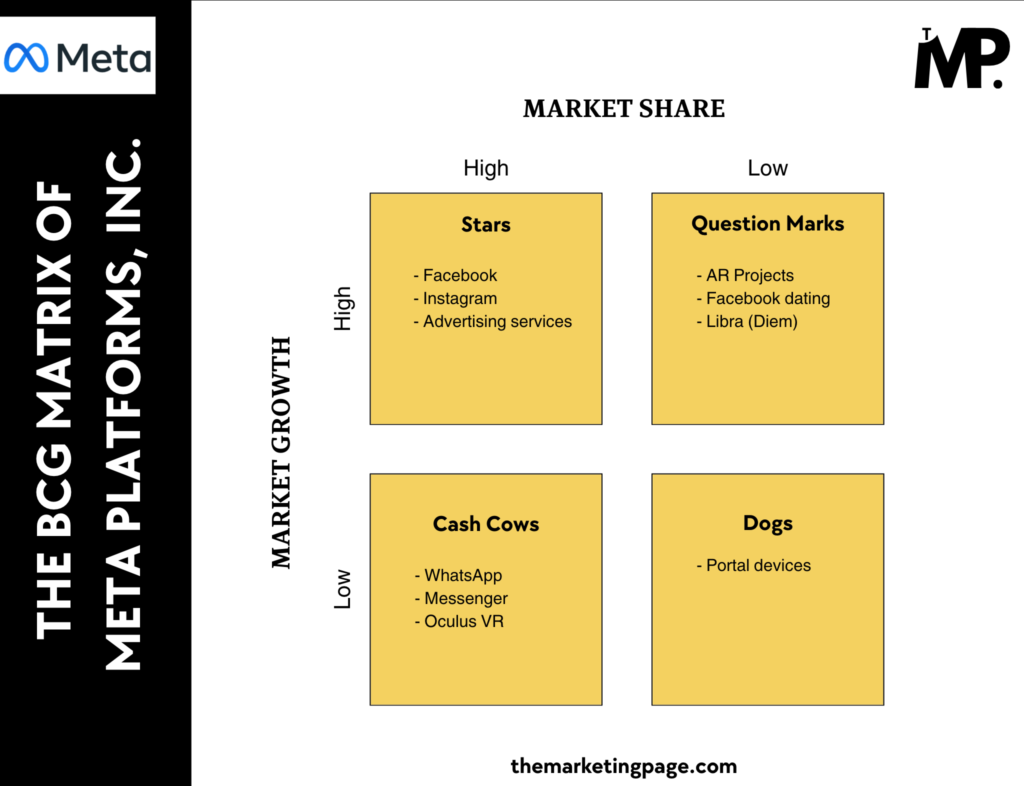

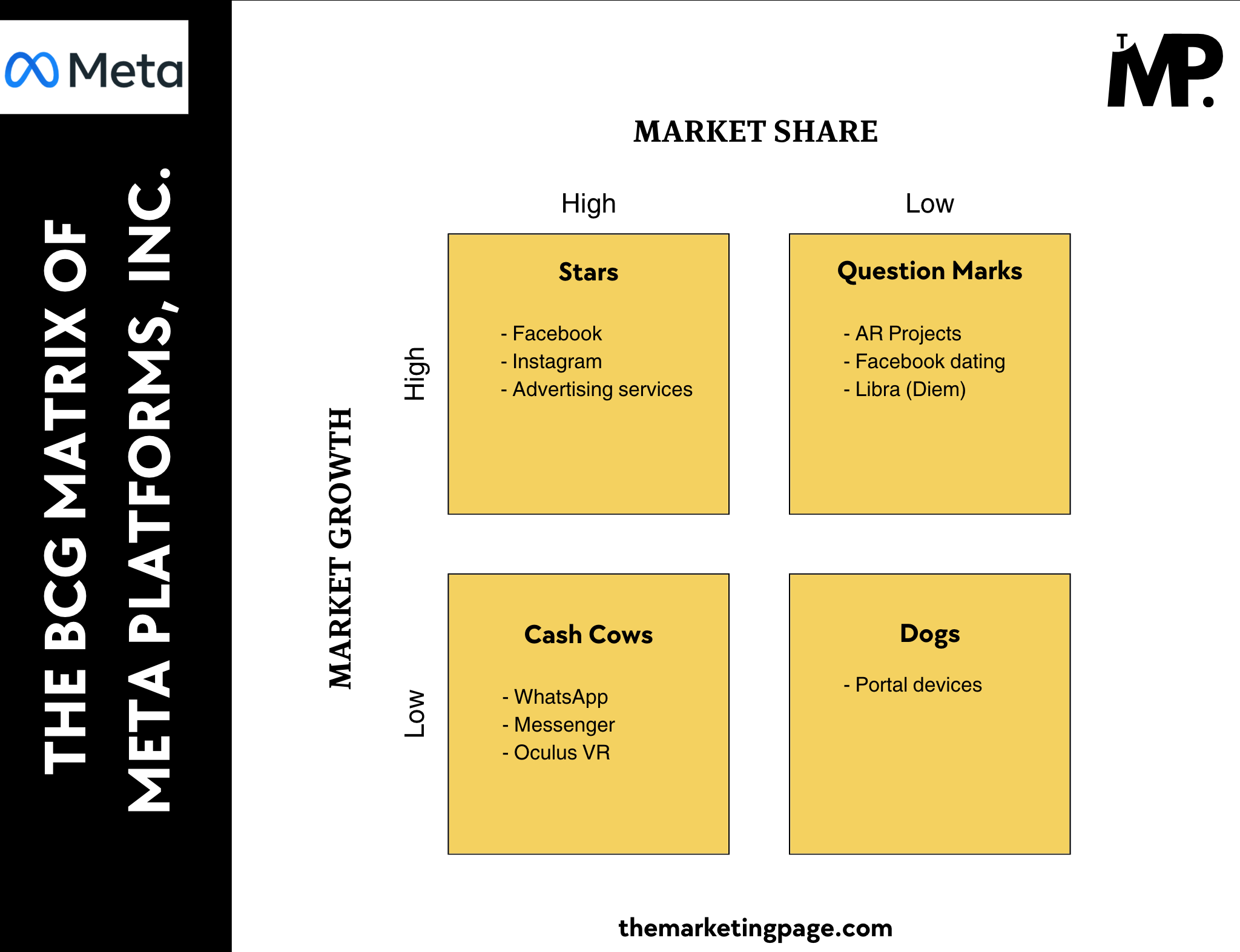

The BCG Matrix offers a clear view of how these products are performing based on market growth and share. Meta’s products can be classified in;

- Stars: High growth, high market share (Facebook, Instagram)

- Cash Cows: High market share, low growth (WhatsApp, Messenger)

- Question Marks: Low share, high growth potential (AR projects, Facebook Dating)

- Dogs: Low share, low growth (Portal, Facebook Watch)

Overview of Meta Platforms, Inc.

Meta Platforms, Inc. is a leading global tech company renowned for its dominance in social media, virtual reality, and digital advertising. Founded in 2004 by Mark Zuckerberg, Meta has transformed from a social networking platform into a multifaceted corporation, with major brands like Facebook, Instagram, and WhatsApp under its umbrella.

Meta’s product lineup includes virtual reality devices like Meta Quest and social networking services. The company continues to explore new technologies, including the metaverse and AI integration, pushing innovation in both consumer electronics and communication tools.

In FY2024, Meta generated $39.07 billion in revenue, with a remarkable net income of $51.43 billion. Under CEO Mark Zuckerberg, Meta focuses on sustainable growth, digital innovation, and expanding its metaverse vision.

BCG Matrix Analysis of Meta Platforms, Inc.

The BCG Matrix provides a clear snapshot of Meta’s product portfolio which helps in identifying which products are driving growth, generating cash, or facing challenges in the market.

Here’s how Meta’s major products fit into the BCG Matrix in 2024:

1. Stars (High Market Share, High Market Growth)

Key Products: Facebook, Instagram, and Advertising Services

As the core product of Meta, Facebook stands as the epitome of a Star product. With over 2.9 billion monthly active users, Facebook dominates the social media landscape. The continuous introduction of innovative features, such as enhanced privacy controls and engaging content formats, ensures Facebook remains at the forefront of social media. This strong market presence and sustained growth in advertising revenues solidify Facebook’s position in the Star quadrant.

Instagram, with its visual-centric approach, has emerged as a crucial component of Meta’s strategy. The platform’s focus on innovative features like Reels, Stories, and its expanding shopping capabilities have boosted its appeal, particularly among younger demographics. With over 2 billion monthly active users, Instagram continues to see impressive growth in both engagement and ad revenue.

2. Cash Cows (High Market Share, Low Market Growth)

Key Products: WhatsApp, Messenger, and Oculus VR

WhatsApp, with more than 2 billion users, is a global leader in messaging services. WhatsApp’s massive user base and its role as a key communication tool for both personal and business use ensure consistent revenue generation. Through business accounts and integrations, WhatsApp generates significant income for Meta, despite the market showing slower growth.

Messenger, another key communication tool in meta’s ecosystem, boasts over 1.3 billion users. Like WhatsApp, Messenger generates steady income primarily through advertising and business communication tools. However, the overall market growth for messaging apps has slowed, pushing Messenger into the Cash Cow quadrant.

Oculus VR has solidified its status in the virtual reality market, offering a range of immersive experiences and applications. While the overall VR market faces slower growth, Oculus benefits from Meta’s strong brand and technological investment. The platform generates consistent revenue through hardware sales and software content.

3. Question Marks (Low Market Share, High Market Growth)

Key Products: AR Projects, Facebook Dating, Libra (Diem)

Meta’s augmented reality (AR) projects, including the Spark AR platform, show promising growth potential in an increasingly AR-focused market. However, Meta currently holds a relatively low market share compared to competitors like Snapchat. The investments in AR technology aim to capture user engagement and enhance advertising experiences, making it a Question Mark that requires strategic focus to unlock its full growth potential.

Facebook Dating is a relatively new feature aiming to compete in the online dating sector. While the market for dating apps is thriving, Facebook Dating has yet to achieve significant market penetration. It offers a unique value proposition i.e. integration into the existing Facebook ecosystem.

Libra, now rebranded as Diem, represents Meta’s attempt to enter the cryptocurrency space. The initiative has faced regulatory scrutiny and challenges which resulted in a low market share. However, the growing interest in cryptocurrencies presents high growth potential.

4. Dogs (Low Market Share, Low Market Growth)

Key Products: Portal Devices, Facebook Watch

Meta’s Portal devices, designed for video calling and smart home integration, have struggled to gain traction in a highly competitive market. Despite being innovative, they face stiff competition from more established players like Amazon’s Echo Show and Google’s Nest Hub. The overall market for smart devices like Portal is stagnating, limiting growth prospects

Facebook Watch, Meta’s attempt at entering the video streaming market, has failed to make a significant impact. Tt faces intense competition from established streaming platforms like YouTube, Netflix, and Amazon Prime. Despite some attempts to push video content through user-generated material and live broadcasts, Facebook Watch has struggled to capture the audience needed for substantial growth.

Meta should consider rethinking its strategy for video content delivery.

Concluding the Analysis

In conclusion, Meta Platforms, Inc. exhibits a diverse product portfolio within the BCG Matrix.

The company thrives with its Star products, such as Facebook and Instagram, which dominate the high-growth social media market.

Meanwhile, its Cash Cows, including Messenger and WhatsApp, provide consistent revenue despite low growth in their respective markets.

On the other hand, Question Marks like AR projects and Facebook Dating present significant growth potential but require strategic focus to capture market share.

Lastly, products like Portal and Facebook Watch fall into the Dog quadrant, indicating a need for reevaluation to enhance overall portfolio performance.

It’s important to note that this analysis represents a limited snapshot in considered factors (market share and market growth) and time (2024).

Leave a Comment