Nestlé is a global powerhouse in the food and beverage industry, with a vast range of products that touch nearly every corner of daily life.

But how does Nestlé decide where to invest and which products to prioritize?

That’s where the BCG Matrix comes in.

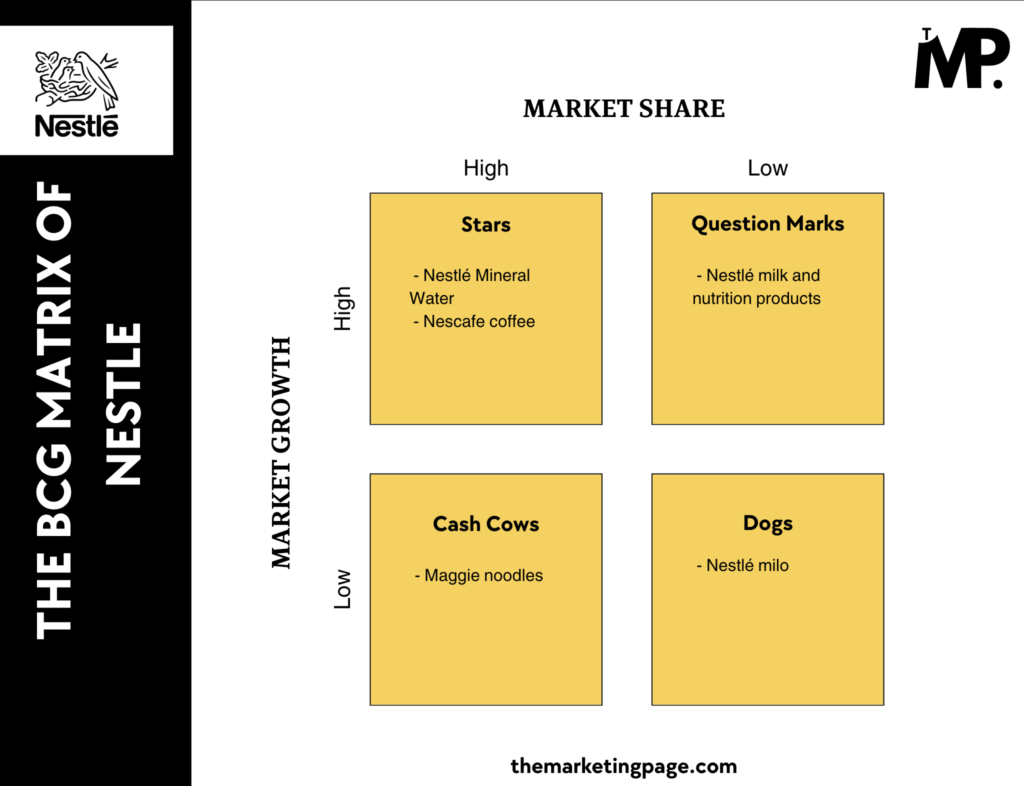

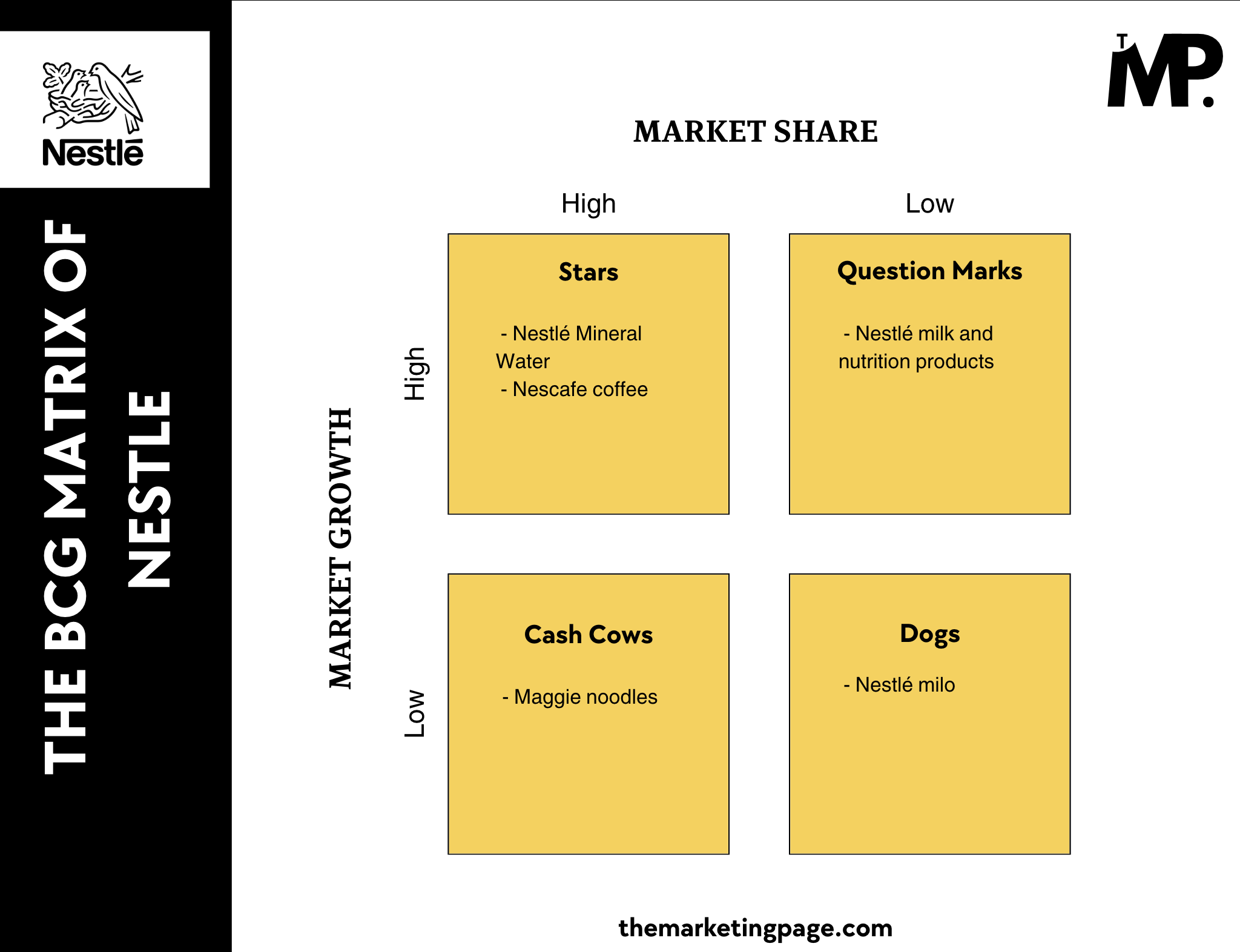

This strategic tool helps categorize products into four groups—Stars, Cash Cows, Question Marks, and Dogs—allowing Nestlé to make smarter decisions and optimize its portfolio.

Overview of Nestlé

Nestlé is a leading global food processing company. Founded in 1866, Nestlé has transformed into a major player in the food and beverage industry. It operates in over 189 countries. The company competes with prominent brands like Mondelez International, Mars, and PepsiCo, maintaining a robust global presence.

Nestlé’s extensive product portfolio includes baby food, coffee, dairy products, breakfast cereals, confectionery, bottled water, ice cream, pet foods, and dietary supplements. Its iconic brands, such as Nescafé and KitKat, have become household names.

Under the leadership of CEO Laurent Freixe, Nestlé is committed to sustainability, health, and innovation, focusing on creating healthier and more sustainable food options. In 2024, the company generated revenue of $53.15 billion with a net income of $12.51 billion, solidifying its position as a leader in the global food industry.

BCG Matrix Analysis of Nestlé

The BCG Matrix provides a clear snapshot of Nestlé’s product portfolio which helps in identifying which products are driving growth, generating cash, or facing challenges in the market.

Here’s how Nestlé’s major products fit into the BCG Matrix in 2024:

1. Stars (High Market Share, High Market Growth)

Key Products: Nestlé mineral water, Nescafe Coffee

Nestlé’s Nescafé Coffee is a prime example. As coffee consumption continues to rise globally, Nescafé holds a dominant position. Its innovative offerings, like instant coffee and premium blends, cater to growing consumer demand.

According to Statista, the global coffee market is projected to grow by 4.3% annually by 2027. This makes this product a focal point for investment.

Nestlé Mineral Water also qualifies as a star. With increasing awareness of health and hydration, bottled water consumption is on the rise. Nestlé’s water brands, such as Pure Life, capitalize on this trend, ensuring steady growth and significant market presence.

2. Cash Cows (High Market Share, Low Market Growth)

Cash cows generate stable profit.

Key Products: Maggie Noodles

Maggi noodles represent a Cash Cow for Nestlé, as they hold a dominant position in the instant noodle market, particularly in regions like Asia and Africa.

While the global instant noodle market is relatively mature, Maggi remains a household staple in countries like India and Pakistan. It dominates market share with its strong brand identity and consistent quality. This stability provides the company with necessary resources to fund other growth initiatives

3. Question Marks (Low Market Share, High Market Growth)

Products that are placed in this quadrant show high growth potential but their market share is low.

Key Products: Nestlé milk products and Nutrition

Nestlé’s milk and nutrition lines fall into this category. The demand for health and wellness products is growing rapidly, but fierce competition from specialized brands like Abbott and Danone limits Nestlé’s market share. However, investments in R&D and marketing could transform these into future stars.

For example, the rise in demand for fortified milk provides a growth opportunity.

Dogs (Low Market Share, Low Market Growth)

Key Products: Nestlé Milo

Dogs are products that contribute minimally to overall profitability.

Nestlé Milo, though popular chocolate malt beverage in some regions, struggles to maintain significant market share globally. The declining demand for sugary beverages and the shift toward healthier alternatives make this product less competitive. For instance, in the U.S., the demand for malt-based drinks has decreased significantly over the years.

The stagnant demand and lack of significant innovation in the Milo line make it challenging for Nestlé to improve its market position, necessitating a review of its product strategy in this category

Concluding the Analysis

In summary, Nestlé’s BCG Matrix highlights its strategic product positioning:

- Stars like mineral water and Nescafe coffee showcase strong growth and market dominance.

- Cash Cows, such as Maggi noodles, provide stable revenue despite low growth.

- Question Marks, including milk products and nutrition, need investment to improve market share.

- Lastly, Nestlé Milo falls into the Dogs category, reflecting limited growth potential.

This analysis underscores the need for Nestlé to focus on leveraging strengths while evaluating the viability of less successful products.

I together with my friends have already been taking note of the nice helpful hints found on the website and quickly came up with a terrible suspicion I had not expressed respect to the blog owner for those techniques. My boys are already for that reason passionate to study all of them and now have simply been loving these things. I appreciate you for actually being indeed thoughtful and for using this form of fantastic themes most people are really wanting to know about. Our own honest regret for not saying thanks to sooner.

It means a lot to know the effort put into the blog resonates with readers like you. Thank you for taking the time to share this—it inspires me to keep creating.