The BCG Matrix is a strategic tool that helps businesses assess their product portfolio. It categorizes products into four groups:

- Stars

- Cash Cows

- Question Marks

- Dogs

For a global giant like Saudi Aramco, this matrix is essential for evaluating its diverse range of assets. By applying the BCG Matrix, Aramco can determine which sectors deserve more investment and which might need reconsideration.

In this blog, we’ll explore which assets are categorized under each group.

Let’s dive in!

Overview of Saudi Aramco

Saudi Aramco, officially known as the Saudi Arabian Oil Group, is a global leader in the oil and gas industry. Founded in 1993, it is primarily state-owned with key figures such as Amin H. Nasser (President & CEO) and Yasir Al-Rumayyan (Chairman) leading the company. With a workforce of around 73,000 employees as of FY2024, Saudi Aramco operates in over 100 countries and continues to be a major player in global energy markets. Its products include petroleum, natural gas, and petrochemical derivatives, generating $331.8 billion in revenue and a net income of $27.56 billion in FY2024.

The company faces stiff competition from industry giants like ExxonMobil, Chevron, BP, Shell, and PetroChina. However, it is focused on diversifying its portfolio and adapting to future energy trends. Saudi Aramco’s strategic initiatives include substantial investments in renewable energy projects such as solar and hydrogen, as well as expanding into non-oil sectors, in line with Saudi Vision 2030. The company is also embracing digitalization and AI to optimize oil production and collaborating with international firms to strengthen its downstream operations. These efforts position Saudi Aramco for continued growth in an evolving global energy landscape.

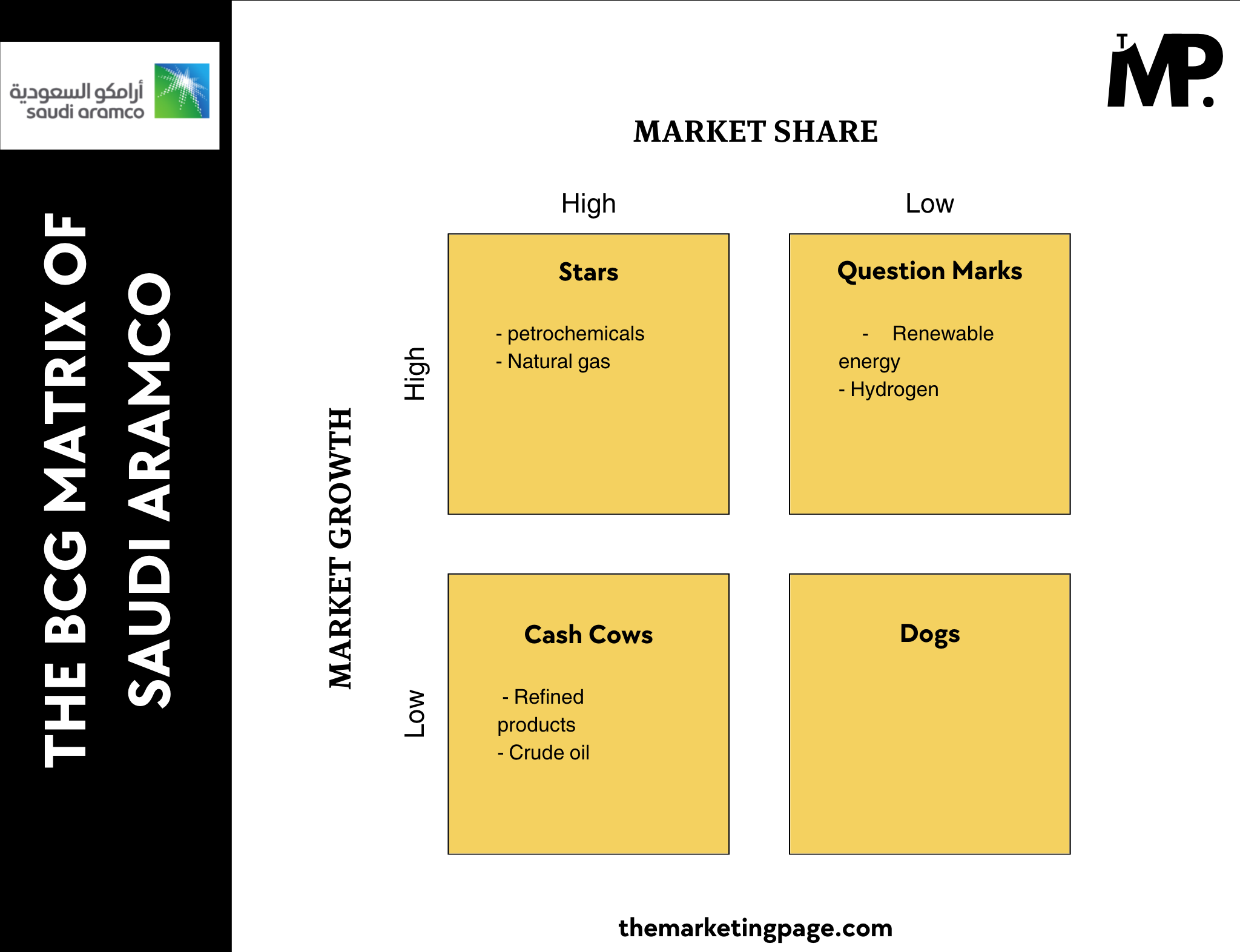

BCG Matrix of Saudi Aramco

1. Stars (High Market Share, High Market Growth)

Key products: Petrochemical, Natural gas

Saudi Aramco’s petrochemical division is one of its most dynamic sectors. The company has increased its petrochemical production capacity by 50% over the past five years because of the strong demand for plastic and chemical products. With increasing global focus on sustainability and the shift toward renewable materials, petrochemicals are expected to remain a vital area for future growth.

Saudi Aramco’s natural gas segment is also rapidly expanding. The company has invested billions of dollars in gas exploration and production to meet the growing global demand for cleaner energy. In 2024, Saudi Aramco announced a new natural gas discovery in the the Eastern Province and Empty Quarter of Saudi Arabia, adding to its already vast reserves. The company aims to become a key player in global gas markets and reduce Saudi Arabia’s reliance on crude oil, making it a key growth sector.

2. Cash Cows (High Market Share, Low Market Growth)

Key Products: Crude oil, Refined products

Saudi Aramco’s crude oil is a cornerstone of the company’s operations, contributing over 50% of its revenue in 2024. The company’s oil reserves are vast, with estimated proven reserves of over 259 billion barrels, giving it a dominant position in the global market. We know that there’s an increasing competition from renewable energy but oil remains critical to global energy and transportation needs. Saudi Aramco’s ability to produce and refine crude oil efficiently allows it to maintain its leadership position in the market and generate consistent profits.

Refined products such as gasoline, diesel, and jet fuel are essential to global economies which makes them a consistent source of revenue for Saudi Aramco. Aramco is one of the largest refiners worldwide. Despite the global shift towards cleaner energy, the demand for refined products remains steady, as they are crucial for transportation, aviation, and industrial use.

3. Question Marks (Low Market Share, High Market Growth)

Key products: Renewable energy, Hydrogen

Renewable energy and hydrogen are considered Question Marks due to their uncertain potential and emerging status within Saudi Aramco’s portfolio.

Saudi Aramco is making strides in renewable energy through large investments in solar and wind energy projects. Aramco, the largest oil company in Saudi Arabia, plans to generate 12 GW of renewable energy by 2030. While this marks a significant commitment, the renewable energy sector still contributes a minor portion to Saudi Aramco’s overall revenue.

Hydrogen is another Question Mark for Saudi Aramco, as it represents a promising yet still-developing market. The company has committed significant funds, such as its $10 billion investment in green hydrogen production in 2024. Hydrogen, especially green hydrogen, is considered a key part of the future energy transition, and Saudi Aramco aims to be a leader in this space.

4. Dogs (Low Market Share, Low Market Growth)

At this time, Saudi Aramco does not have any products classified as Dogs in its portfolio.

The company has strategically focused on maintaining high-value products and avoiding investments in underperforming sectors. All of its current products, such as crude oil, refined products, and petrochemicals, are core drivers of revenue, with no products seen as non-profitable or a drag on resources.

Conclusion

Saudi Aramco’s application of the BCG Matrix highlights its sharp focus on sustainable growth and innovation. From high-growth stars like petrochemicals and natural gas to steady cash cows like crude oil and refined products, the company efficiently allocates resources to maximize returns.

While renewable energy and hydrogen represent future opportunities with their “Question Mark” status, Aramco’s strategic investments position it as a leader in the evolving energy landscape. By continuously aligning its portfolio with market trends and Saudi Vision 2030, Saudi Aramco not only maintains its global dominance but also ensures adaptability for a sustainable future.

Leave a Comment