Microsoft operates in dynamic markets where proper resource allocation is critical. The BCG Matrix helps identify where to double down and where to optimize.

The BCG Matrix underscores how this tech giant balances legacy products with bold ventures by categorizing them in

- Stars

- Cash cows

- Question marks

- Dogs

Overview of Microsoft

Microsoft Corporation is a leading global technology company renowned for its innovative software, hardware, and cloud services. Founded in 1975, Microsoft has evolved into a major player in the information technology industry, operating in over 190 countries. The company competes with industry giants such as Google, Apple, and IBM, maintaining a strong presence in the market.

Microsoft’s extensive product portfolio includes widely used software like the Windows operating system, Microsoft Office suite, and cloud services through Azure. Additionally, the company has made significant strides in hardware with products like Surface devices and gaming consoles such as the Xbox, appealing to both business and consumer markets.

Under the leadership of CEO Satya Nadella, Microsoft continues to focus on innovation, sustainability, and global market expansion. In 2024, the company reported revenue of $245.12 billion and a net income of $88.1 billion.

Also read SWOT Analysis of Microsoft [2024].

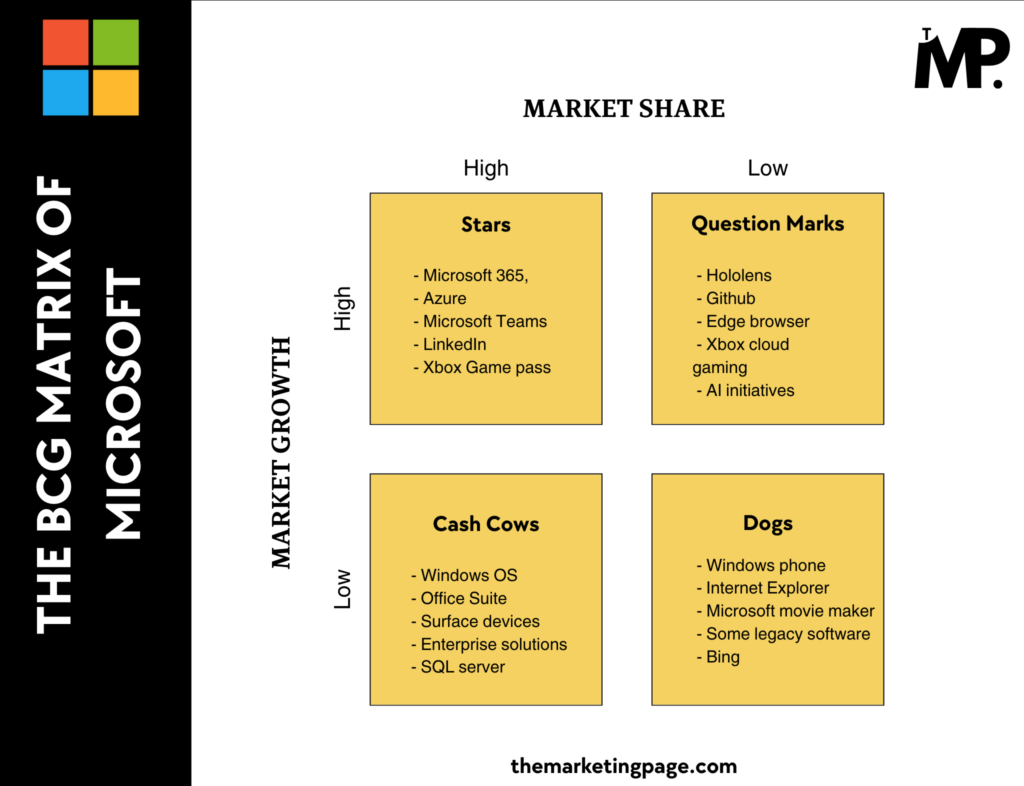

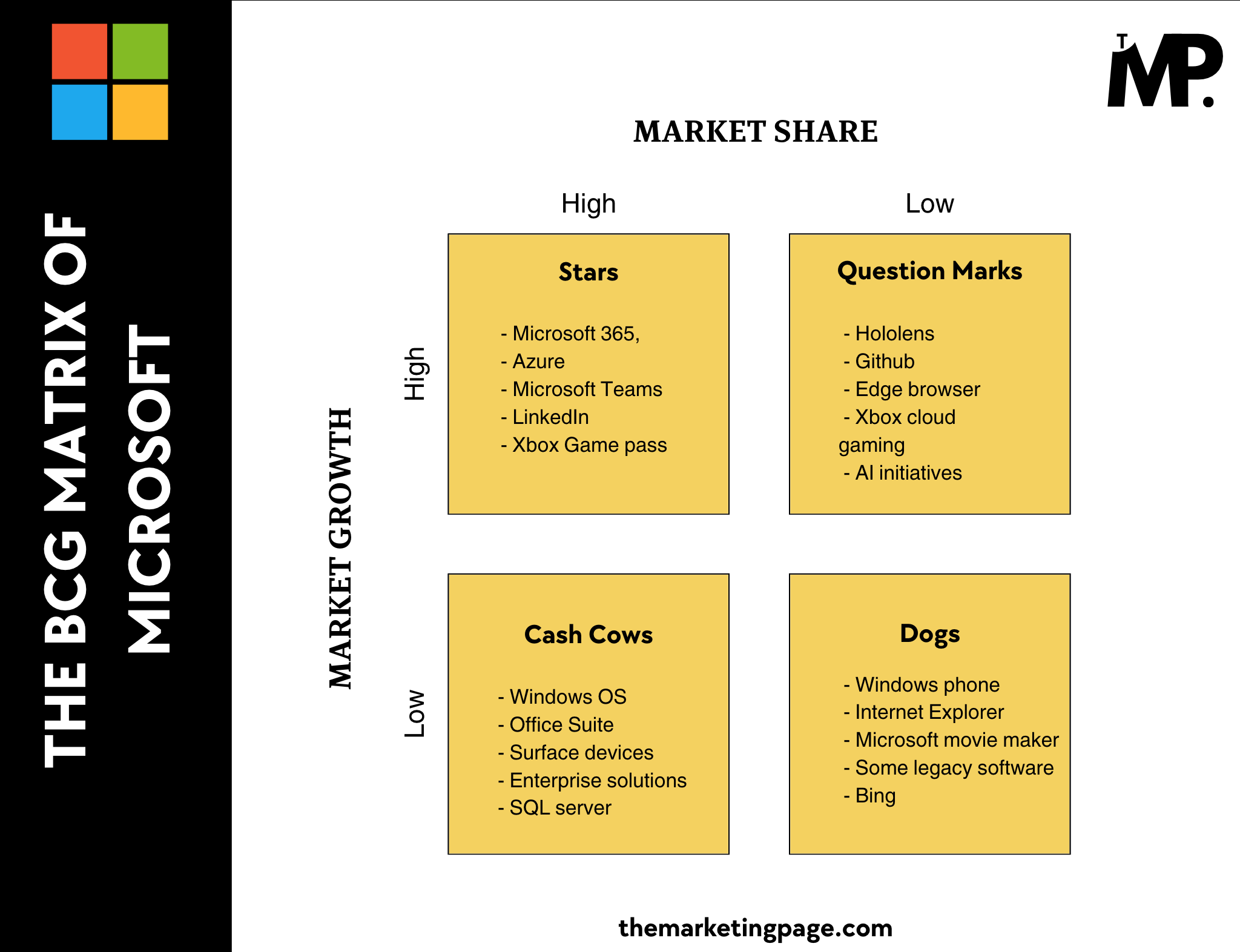

BCG Matrix of Microsoft

Now, let’s explore how Microsoft’s diverse product range fits into the BCG Matrix to evaluate their market positions and growth potential.

1. Stars (High Market Share, High Market Growth)

Key Products: Microsoft 365, Azure, Microsoft Teams, LinkedIn, Xbox Game pass

Microsoft’s Azure exemplifies this category. It leads the cloud computing sector with innovations like AI integrations and hybrid cloud solutions followed by 24% market share. Azure competes directly with AWS.

Similarly, Microsoft 365 addressed enterprise productivity needs. It has high adaptability to market trends due to which it is adopted by enterprise people.

Microsoft Teams has seen explosive growth, exceeding 280 million active users by 2023, driven by hybrid work trends.

LinkedIn benefits from increasing professional networking demand, while Xbox Game Pass revolutionizes gaming subscriptions with over 25 million subscribers, reflecting its star potential.

2. Cash Cows (High Market Share, Low Market Growth)

Key Products: Windows Operating System, Office Suite, Surface devices, Enterprise solutions, SQL server

As we know that Cash Cows are mature products generating stable revenues in slow-growth markets. Cash cows finance other ventures.

The Windows Operating System dominates this domain as it remains the cornerstone of personal computing, commanding over 75% desktop OS market share. This domination provides steady cash flows in a saturated market.

Office Suite sustains global relevance due to embedded enterprise reliance. It continues to drive predictable revenue from business and academic institutions worldwide.

Surface devices and enterprise software like SQL Server cater to loyal customer base. It exemplifies products with reliable cash inflows despite market saturation. This dhows that how Microsoft capitalizes on its strong brand reputation and institutional presence.

3. Question Marks (Low Market Share, High Market Growth)

Key Products: Hololens, Github, Edge browser, Xbox cloud gaming, AI initiatives

In the BCG Matrix, Question Marks hold potential but demand strategic investments. HoloLens showcases innovation in augmented reality but struggles to gain traction due to high costs and niche applications.

Similarly, GitHub, despite being a leading code repository, drives collaboration among developers but faces monetization challenges.

The Edge browser competes in the crowded browser space (Google, Firefox, Safari) with less than 5% market share. AI-powered integrations, like Bing Chat, show promise.

Xbox Cloud Gaming targets the evolving gaming experience but struggles with scalability.

These products require careful evaluation to determine their potential transformation into stars.

4. Dogs (Low Market Share, Low Market Growth)

Key Products: Windows phone, Internet Explorer, Microsoft movie maker, Some legacy software products, Bing

Dogs in the BCG Matrix represent products with minimal returns, often considered for phase-out or restructuring.

Microsoft’s Windows Phone and Internet Explorer reflect past efforts in highly competitive markets that didn’t sustain success. internet Explorer was phased out in favor of Microsoft Edge but remains symbolic to outdated technology.

Some legacy software like Microsoft 2010 and Windows 7 have declining graphs on its users base.

Microsoft Movie Maker and Bing (limited-growth platform) continue to underperform, with niche or shrinking relevance. Bing continues to lag behind Google in search engine dominance, holding less than 10% market share, despite incremental improvements in AI features.

Conclusion

Microsoft thrives across industries, from software to hardware, making BCG Matrix framework invaluable for understanding its strategic positioning.

The clear snapshot by BCG Matrix shows the following.

- Stars: Azure is Microsoft’s crown jewel, dominating the cloud market with a projected 30% growth by 2025, fueled by enterprise adoption and AI advancements.

- Cash Cows: Products like Microsoft Office generate consistent revenue in a mature market. Businesses and individuals rely on Office 365 subscriptions, contributing billions annually.

- Question Marks: Innovations like HoloLens fall here. Augmented reality (AR) is a high-growth field but lacks mass adoption, needing strategic investment to break through.

- Dogs: Products like Microsoft movie maker serve as a reminder of past missteps, now largely irrelevant as Microsoft pivots to more competitive areas.

By leveraging its cash cows to fund innovation in its stars and question marks, Microsoft remains a leader in technology.

Also read the BCG Matrix of Nike [2024].

I simply could not leave your web site prior to suggesting that I really loved the standard info a person provide to your guests? Is going to be back frequently in order to check out new posts

I would like to thank you for the efforts you’ve put in writing this blog. I’m hoping the same high-grade blog post from you in the upcoming as well. Actually your creative writing skills has inspired me to get my own website now. Really the blogging is spreading its wings quickly. Your write up is a good example of it.

I like this post, enjoyed this one thankyou for putting up.

It’s really a great and useful piece of info. I’m glad that you shared this useful info with us. Please keep us informed like this. Thanks for sharing.